After two years of high competition and fast-rising prices in residential real estate, the market is at last seeing signs of cooling off. Amid higher prices and recent interest rate hikes, demand is leveling out. Pending home sales have begun to decline, online searches, showings, and mortgage applications are down, and many experts anticipate a rebalancing in the market over the next year.

While many buyers may be starting to feel relief, younger buyers have had an especially difficult time in this market and may continue to struggle. The Millennial generation—Americans aged 26 to 41—are currently in their peak homebuying years, representing 43% of buyers according to recent data from the National Association of Realtors. Because they are earlier in their working lives, young shoppers may have less saved up to put toward a home, and they also tend to be first-time buyers, which means they do not have existing home equity available to help finance a purchase. While the market was at peak competitiveness, this made it harder to outbid buyers who had more resources at their disposal. Now, with home prices at historic highs and interest rates increasing, many young buyers are being priced out of the market altogether.

To overcome these challenges, some young buyers have relied on older friends and family members with more financial resources to support a home purchase. This can happen informally, like with gifts to put toward a down payment or closing costs, but support can also come in the form of a co-signer on a mortgage loan. Co-signers are people who agree to be responsible for loan payments if the primary signer defaults. Because co-signers’ financial resources and credit history are also evaluated as part of a loan application, this helps buyers with low incomes, more debt, or a patchy employment history increase their likelihood of qualifying for a loan and receiving lower interest rates or higher approval amounts.

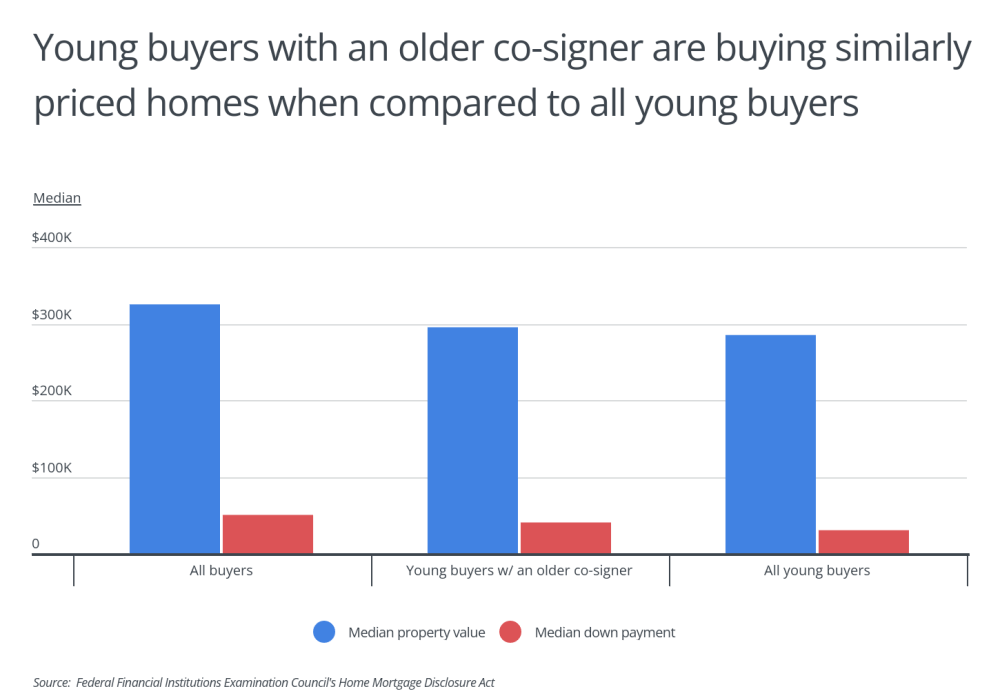

Young buyers appear to be relying on older co-signers simply to enter the housing market, rather than using co-signers’ financial assistance to purchase more expensive homes. This is evidenced by similar property values and down payment amounts across young buyers with and without older co-signers, according to data from the Home Mortgage Disclosure Act. The median property value and down payment for young buyers with an older co-signer is $295,000 and $40,000, respectively, compared to $285,000 and $30,000 for all young buyers. But both groups of buyers lag behind typical figures overall: for all buyers, the median property value is $325,000, and the median down payment is $50,000.

RELATED

Don’t try to do the job of a general contractor yourself. Contractors know that their businesses can be made or broken on their reputation, and they will work hard to get your project done on time, orchestrating the work of subcontractors so that the whole project turns out just as planned. Let Porch help you find the right general contractor for your home project.

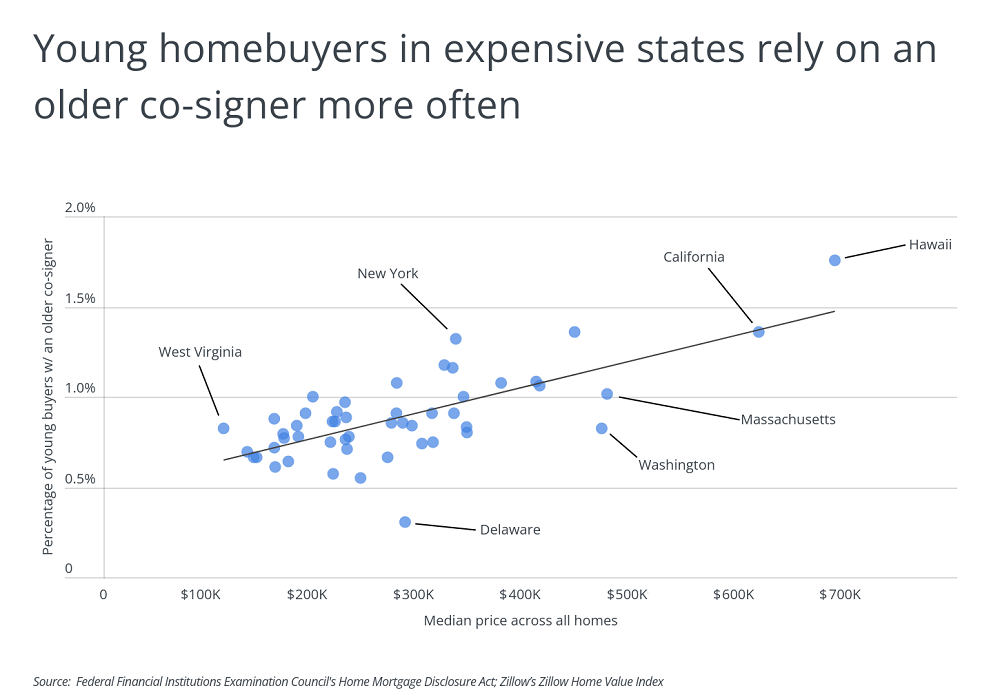

Co-signers are especially helpful to young buyers in markets that tend to be more expensive for housing. There is a positive correlation between median home price in a state and the percentage of young buyers with an older co-signer. The three states with the highest percentage of young buyers who have a co-signer—Hawaii, Colorado, and California—respectively rank first, fifth, and second in the U.S. for overall home prices.

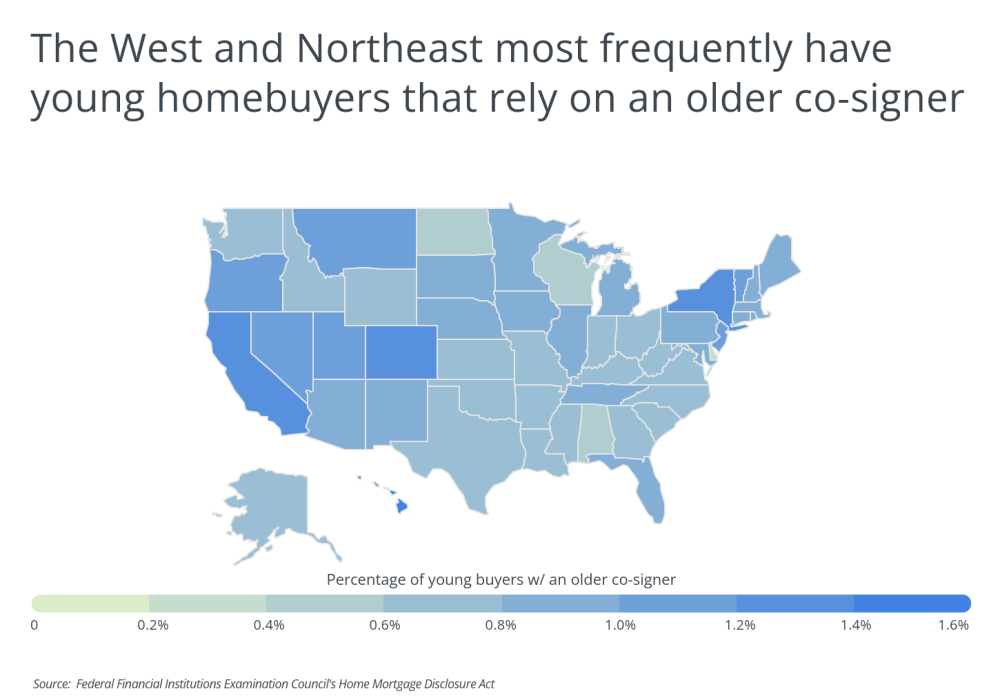

Due to the relationship between home prices and the presence of a co-signer, states in the West and Northeast that tend to be more expensive also tend to have younger buyers relying on co-signers more often. In contrast, more affordable states in the Southeast and Central U.S. have fewer young homebuyers with a co-signer.

To determine the states with the highest percentage of young homebuyers with an older co-signer, researchers at Porch analyzed the latest data from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. The researchers ranked states by the percentage of young homebuyers (34 years old or younger) with an older co-signer (55 years old or older). In the event of a tie, the state with the higher median property value for young homebuyers with an older co-signer was ranked higher.

States With the Most Young Homebuyers With an Older Co-Signer

Photo Credit: marchello74 / Shutterstock

15. Illinois

- Percentage of young buyers w/ an older co-signer: 0.919%

- Median property value for young buyers w/ an older co-signer: $225,000

- Median property value across all young buyers: $245,000

- Median down payment for young buyers w/ an older co-signer: $30,000

- Median down payment across all young buyers: $20,000

LEARN MORE

A handyman often has carpentry or construction experience and has the know-how to tackle a variety of projects, including painting jobs, small repairs, and TV mounting or hanging mirrors. Let Porch help you find a trusted handyman near you.

Photo Credit: turtix / Shutterstock

14. New Mexico

- Percentage of young buyers w/ an older co-signer: 0.969%

- Median property value for young buyers w/ an older co-signer: $215,000

- Median property value across all young buyers: $215,000

- Median down payment for young buyers w/ an older co-signer: $50,000

- Median down payment across all young buyers: $30,000

Photo Credit: Mihai_Andritoiu / Shutterstock

13. Nebraska

- Percentage of young buyers w/ an older co-signer: 0.997%

- Median property value for young buyers w/ an older co-signer: $195,000

- Median property value across all young buyers: $205,000

- Median down payment for young buyers w/ an older co-signer: $20,000

- Median down payment across all young buyers: $20,000

Photo Credit: Mihai_Andritoiu / Shutterstock

12. Rhode Island

- Percentage of young buyers w/ an older co-signer: 1.002%

- Median property value for young buyers w/ an older co-signer: $315,000

- Median property value across all young buyers: $295,000

- Median down payment for young buyers w/ an older co-signer: $50,000

- Median down payment across all young buyers: $30,000

Photo Credit: ESB Professional / Shutterstock

11. Massachusetts

- Percentage of young buyers w/ an older co-signer: 1.018%

- Median property value for young buyers w/ an older co-signer: $435,000

- Median property value across all young buyers: $445,000

- Median down payment for young buyers w/ an older co-signer: $70,000

- Median down payment across all young buyers: $60,000

Photo Credit: Bob Pool / Shutterstock

10. Oregon

- Percentage of young buyers w/ an older co-signer: 1.059%

- Median property value for young buyers w/ an older co-signer: $365,000

- Median property value across all young buyers: $385,000

- Median down payment for young buyers w/ an older co-signer: $50,000

- Median down payment across all young buyers: $40,000

Photo Credit: Mihai_Andritoiu / Shutterstock

9. New Jersey

- Percentage of young buyers w/ an older co-signer: 1.079%

- Median property value for young buyers w/ an older co-signer: $365,000

- Median property value across all young buyers: $375,000

- Median down payment for young buyers w/ an older co-signer: $60,000

- Median down payment across all young buyers: $50,000

Photo Credit: Sean Pavone / Shutterstock

8. Vermont

- Percentage of young buyers w/ an older co-signer: 1.080%

- Median property value for young buyers w/ an older co-signer: $215,000

- Median property value across all young buyers: $265,000

- Median down payment for young buyers w/ an older co-signer: $40,000

- Median down payment across all young buyers: $30,000

Photo Credit: photo.ua / Shutterstock

7. Utah

- Percentage of young buyers w/ an older co-signer: 1.081%

- Median property value for young buyers w/ an older co-signer: $335,000

- Median property value across all young buyers: $335,000

- Median down payment for young buyers w/ an older co-signer: $40,000

- Median down payment across all young buyers: $30,000

Photo Credit: trekandshoot / Shutterstock

6. Nevada

- Percentage of young buyers w/ an older co-signer: 1.159%

- Median property value for young buyers w/ an older co-signer: $325,000

- Median property value across all young buyers: $325,000

- Median down payment for young buyers w/ an older co-signer: $50,000

- Median down payment across all young buyers: $30,000

Photo Credit: Mihai_Andritoiu / Shutterstock

5. Montana

- Percentage of young buyers w/ an older co-signer: 1.176%

- Median property value for young buyers w/ an older co-signer: $295,000

- Median property value across all young buyers: $295,000

- Median down payment for young buyers w/ an older co-signer: $50,000

- Median down payment across all young buyers: $30,000

TRENDING

An electrician’s hourly rate will vary depending upon a variety of factors, including where you’re located, the type of electrician you hire, and the kind of project you need help with. Here’s everything you need to know about the best local electricians in your area.

Photo Credit: Ingus Kruklitis / Shutterstock

4. New York

- Percentage of young buyers w/ an older co-signer: 1.317%

- Median property value for young buyers w/ an older co-signer: $425,000

- Median property value across all young buyers: $335,000

- Median down payment for young buyers w/ an older co-signer: $70,000

- Median down payment across all young buyers: $40,000

Photo Credit: Ingus Kruklitis / Shutterstock

3. California

- Percentage of young buyers w/ an older co-signer: 1.358%

- Median property value for young buyers w/ an older co-signer: $535,000

- Median property value across all young buyers: $545,000

- Median down payment for young buyers w/ an older co-signer: $100,000

- Median down payment across all young buyers: $100,000

Photo Credit: Jacob Boomsma / Shutterstock

2. Colorado

- Percentage of young buyers w/ an older co-signer: 1.361%

- Median property value for young buyers w/ an older co-signer: $385,000

- Median property value across all young buyers: $405,000

- Median down payment for young buyers w/ an older co-signer: $60,000

- Median down payment across all young buyers: $50,000

Photo Credit: Izabela23 / Shutterstock

1. Hawaii

- Percentage of young buyers w/ an older co-signer: 1.752%

- Median property value for young buyers w/ an older co-signer: $545,000

- Median property value across all young buyers: $555,000

- Median down payment for young buyers w/ an older co-signer: $100,000

- Median down payment across all young buyers: $80,000

Detailed Findings & Methodology

To determine the states with the highest percentage of young homebuyers with an older co-signer, researchers at Porch analyzed the latest data from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. Only conventional, non-commercial, home purchase loans that originated in 2020 were considered in the analysis. Additionally, data on median home values are from Zillow’s Zillow Home Value Index. The researchers ranked states by the percentage of young homebuyers (34 years old or younger) with an older co-signer (55 years old or older). Researchers also calculated the median property value for young homebuyers with an older co-signer, median property value across all young homebuyers, median down payment for young homebuyers with an older co-signer, and median down payment across all young homebuyers. In the event of a tie, the state with the higher median property value for young homebuyers with an older co-signer was ranked higher.