The classic saying in real estate is “Location, Location, Location.” Everyone who buys a home knows that where homes are located—by market, by neighborhood, and even by block—can cause wide variation in what they will list and ultimately sell for.

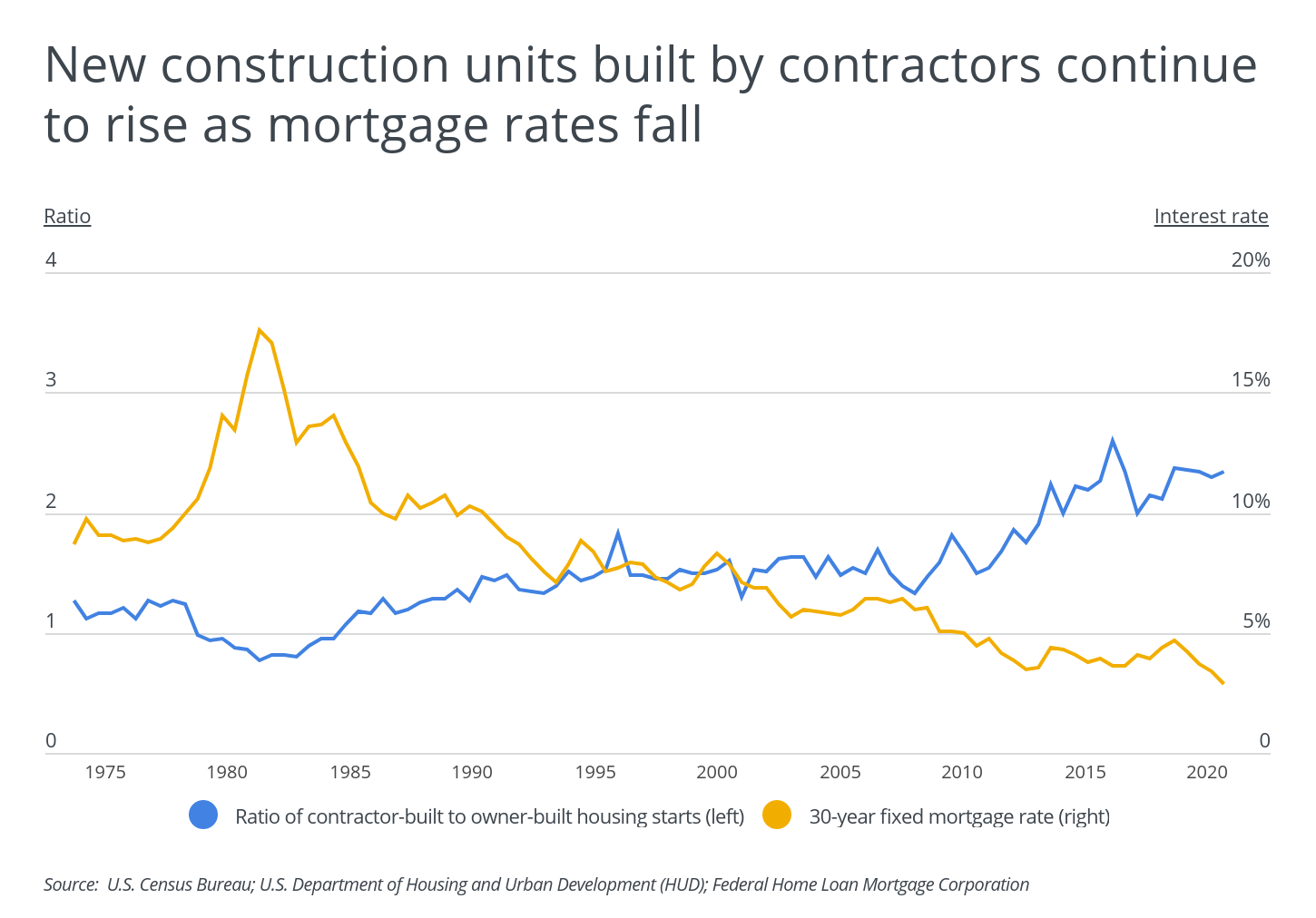

Changes in the real estate market during the COVID-19 pandemic have shifted some of the calculus when it comes to choosing both the location and the particular home. On the one hand, low interest rates have increased the amount of money buyers are willing to spend, as evidenced in part by the ratio of contractor-built to owner-built housing starts. When interest rates are high, many potential buyers opt to build their own home as a way to save money, pushing the ratio down. Conversely, when interest rates are low, buyers are more willing to pay a premium on a home that someone else built, and the ratio rises.

Alongside lower mortgage rates and the corresponding increase in what buyers are willing to spend, COVID-19 has ushered in a resurgence of interest in large homes. With more people transitioning to virtual work and schooling, many previously high-demand markets have cooled off, while lower-cost markets offering larger houses and more “bang-for-the-buck” have new appeal.

To find the real estate markets where buyers can get the most for their money, researchers at Porch analyzed data from Zillow, Realtor.com, and the U.S. Census Bureau. They created a composite score based on five key metrics related to price, affordability, home size, and the recent and projected change in value.

At the state level, Kansas leads the nation by a large margin, followed by a number of other lower-cost states in the South and Midwest. Notably absent from the top of the list are coastal states like California and Massachusetts, where price per square foot and home payments as a share of income are much higher than in the rest of the country.

RELATED

If you’re looking for a versatile option for flooring, laminate is an excellent choice. Learn more and find out what it would cost to install laminate flooring in your home with Porch.

At the metro level, it is unsurprising to find that many of the best bang-for-the-buck markets are located in the same states that rate highly for value. Oft-overlooked large metros like Indianapolis, Kansas City, and Cleveland top the list, a function of low housing costs both on a per square foot basis and as a share of income.

Here are the best “bang-for-the-buck” real estate markets.

Large metros offering the best “bang-for-the-buck”

Photo Credit: Alamy Stock Photo

15. Phoenix, AZ

- Composite score: 78.6

- Median list price: $403,792

- Price per square foot: $201.21

- Monthly mortgage payment as a percentage of household income: 25.9%

- Median home size (square feet): 2,121

- Previous 1-year change in home price: +7.9%

- Projected 1-year change in home price: +16.1%

TRENDING

A brand new fence can do wonders for the outside of your home. Fences come in many shapes and sizes, and some are more affordable than you might think. Use Porch’s fence cost calculator to help you plan your next fence installation project.

Photo Credit: Alamy Stock Photo

14. Rochester, NY

- Composite score: 78.8

- Median list price: $236,986

- Price per square foot: $125.99

- Monthly mortgage payment as a percentage of household income: 16.2%

- Median home size (square feet): 1,761

- Previous 1-year change in home price: +11.3%

- Projected 1-year change in home price: +8.9%

Photo Credit: Alamy Stock Photo

13. Richmond, VA

- Composite score: 79.2

- Median list price: $347,950

- Price per square foot: $156.34

- Monthly mortgage payment as a percentage of household income: 20.8%

- Median home size (square feet): 2,207

- Previous 1-year change in home price: +7.5%

- Projected 1-year change in home price: +10.1%

Photo Credit: Alamy Stock Photo

12. Grand Rapids, MI

- Composite score: 79.5

- Median list price: $306,125

- Price per square foot: $150.52

- Monthly mortgage payment as a percentage of household income: 19.8%

- Median home size (square feet): 2,018

- Previous 1-year change in home price: +6.4%

- Projected 1-year change in home price: +12.0%

Photo Credit: Alamy Stock Photo

11. San Antonio, TX

- Composite score: 79.9

- Median list price: $301,805

- Price per square foot: $144.93

- Monthly mortgage payment as a percentage of household income: 20.5%

- Median home size (square feet): 2,220

- Previous 1-year change in home price: +1.7%

- Projected 1-year change in home price: +11.1%

Photo Credit: Alamy Stock Photo

10. Oklahoma City, OK

- Composite score: 80.0

- Median list price: $268,581

- Price per square foot: $130.13

- Monthly mortgage payment as a percentage of household income: 18.7%

- Median home size (square feet): 2,105

- Previous 1-year change in home price: +7.7%

- Projected 1-year change in home price: +8.1%

Photo Credit: Alamy Stock Photo

9. Dallas-Fort Worth, TX

- Composite score: 81.1

- Median list price: $351,276

- Price per square foot: $152.27

- Monthly mortgage payment as a percentage of household income: 20.5%

- Median home size (square feet): 2,320

- Previous 1-year change in home price: +1.0%

- Projected 1-year change in home price: +12.6%

Photo Credit: Alamy Stock Photo

8. Houston, TX

- Composite score: 82.1

- Median list price: $322,206

- Price per square foot: $136.89

- Monthly mortgage payment as a percentage of household income: 19.6%

- Median home size (square feet): 2,368

- Previous 1-year change in home price: +2.7%

- Projected 1-year change in home price: +10.8%

Photo Credit: Alamy Stock Photo

7. Birmingham, AL

- Composite score: 82.9

- Median list price: $263,736

- Price per square foot: $122.40

- Monthly mortgage payment as a percentage of household income: 18.8%

- Median home size (square feet): 2,091

- Previous 1-year change in home price: +5.7%

- Projected 1-year change in home price: +11.7%

Photo Credit: Alamy Stock Photo

6. Charlotte, NC

- Composite score: 83.1

- Median list price: $358,347

- Price per square foot: $153.40

- Monthly mortgage payment as a percentage of household income: 23.3%

- Median home size (square feet): 2,331

- Previous 1-year change in home price: +5.1%

- Projected 1-year change in home price: +15.1%

Photo Credit: Alamy Stock Photo

5. Salt Lake City, UT

- Composite score: 83.1

- Median list price: $491,591

- Price per square foot: $191.74

- Monthly mortgage payment as a percentage of household income: 27.0%

- Median home size (square feet): 2,664

- Previous 1-year change in home price: +13.4%

- Projected 1-year change in home price: +16.0%

RELATED

If you can’t resist the soft feeling under your feet, carpet is the best choice for your home, but it’s important to replace the carpet in your home every 5-15 years. Find out what it would cost to install carpet in your home.

Photo Credit: Alamy Stock Photo

4. Raleigh, NC

- Composite score: 83.2

- Median list price: $378,824

- Price per square foot: $154.92

- Monthly mortgage payment as a percentage of household income: 20.5%

- Median home size (square feet): 2,480

- Previous 1-year change in home price: +3.4%

- Projected 1-year change in home price: +14.0%

Photo Credit: Alamy Stock Photo

3. Cleveland, OH

- Composite score: 83.8

- Median list price: $208,061

- Price per square foot: $98.97

- Monthly mortgage payment as a percentage of household income: 15.2%

- Median home size (square feet): 1,901

- Previous 1-year change in home price: +6.2%

- Projected 1-year change in home price: +10.4%

Photo Credit: Alamy Stock Photo

2. Kansas City, MO

- Composite score: 84.6

- Median list price: $338,726

- Price per square foot: $145.98

- Monthly mortgage payment as a percentage of household income: 20.9%

- Median home size (square feet): 2,294

- Previous 1-year change in home price: +9.3%

- Projected 1-year change in home price: +14.8%

Photo Credit: Alamy Stock Photo

1. Indianapolis, IN

- Composite score: 87.0

- Median list price: $283,562

- Price per square foot: $113.70

- Monthly mortgage payment as a percentage of household income: 18.9%

- Median home size (square feet): 2,308

- Previous 1-year change in home price: +5.5%

- Projected 1-year change in home price: +14.1%

Detailed findings & methodology

The data used in this analysis is from Zillow, Realtor.com, and the U.S. Census Bureau. To determine the best “bang-for-the-buck” real estate markets, researchers created a composite score based on the following factors and weights:

- Price per square foot (40%) – the median price per square foot for 2020

- Monthly mortgage payment as a percentage of household income (10%) – the estimated monthly mortgage payment based on the median list price and median household income; assuming a 30-year fixed rate mortgage with a 20% down payment

- Median home size (20%) – the median home size in square feet for 2020

- Previous 1-year change in home price (5%) – the average monthly year-over-year change in list price for 2020

- Projected 1-year change in home price (25%)* – the forecasted one-year change in home price from Zillow

With the exception of the monthly mortgage payment as a percentage of household income, higher values corresponded to a higher score for all factors considered. In the event of a tie, the metro with the lower median listing price was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000–349,999), midsize (350,000–999,999), and large (1,000,000 or more).

*Not available for U.S. states