Whether you’re in the market to buy or sell a home—or both, as is often the case for homeowners on the move—you’re left with a simple dilemma: Sell it as-is or do some renovations? For buyers, you might have a similar train of thought: Should you buy a fixer-upper or something that’s more turnkey?

In most cases, the final decision may come down to dollars and cents. If you can sell your house for top dollar, you may not want to sink any extra capital into the property. Similarly, if you can buy your dream house within budget, why commit your time and energy to taking on unnecessary renovations?

Before the renovation bug hits, it might help to know how much it costs to take on certain home improvement projects and how much return on investment you can reasonably expect.

For an inside look at the practical side of upgrading to an open-concept kitchen or new hardwood floors, we surveyed over 970 homeowners for their insight and opinion. Keep reading to discover which buyers are willing to go over budget to get a move-in ready home; the most common renovations homeowners make to sell their property; and which of these improvements might add the most value to your home.

Fixer-upper?

Buying a house, in almost any condition, is a major purchase. For most people, there are very few investments that will ever have as many zeros in the price tag. Whatever the cost, you’ll be committed to 10, 15, or even 30 years before the property is fully paid off. Because the cost is already so high, most financial experts recommend homeowners consider more than just their mortgages to help set a realistic budget for how much house they can reasonably afford.

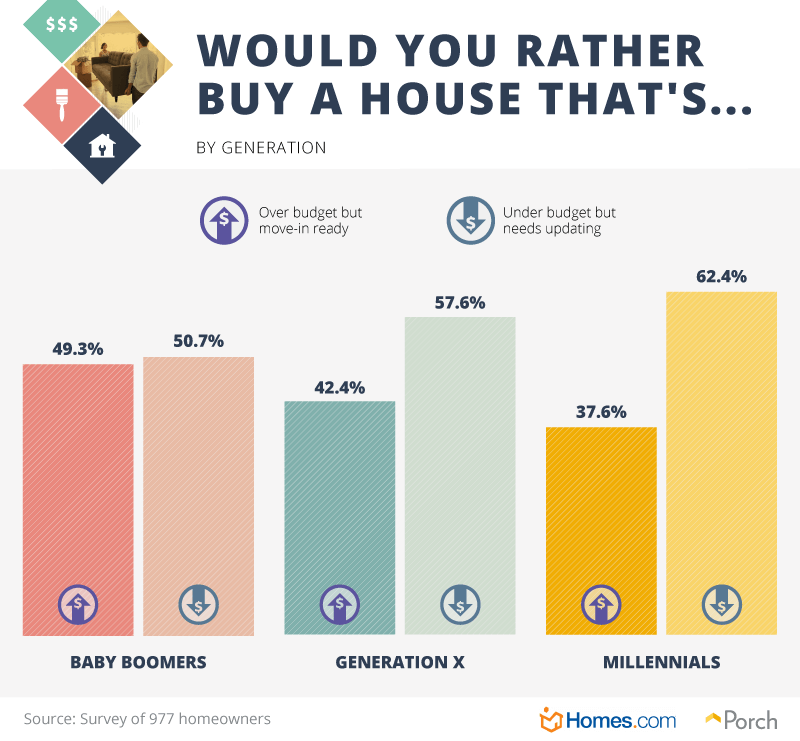

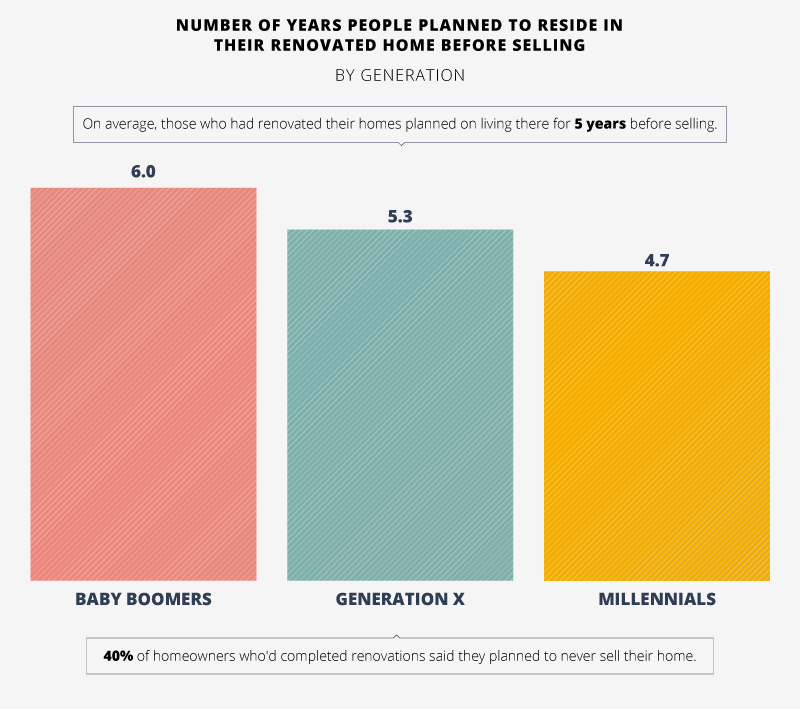

Of course, once you start pricing out your options and deciding what’s worth paying for and what isn’t, you may find a certain amount of gray area in the final purchase price. At most, we found baby boomers were the most willing to extend their budget to get a move-in ready home. Forty-nine percent of baby boomers told us they were comfortable upping their budgets, and 51 percent preferred to save money and do the updates themselves. In contrast, fewer Generation X homeowners (42 percent) and millennials (38 percent) were willing to overspend to get the amenities and design features they most wanted as opposed to doing the renovations themselves.

Competitive comps

No matter what you see on popular home renovation shows, there’s no rule that says you have to remodel your kitchen or install a massive master ensuite to get a good price on your home. And, while popular designer upgrades aren’t a necessity, some improvements can sway buyers and recoup the cost of the project or installation.

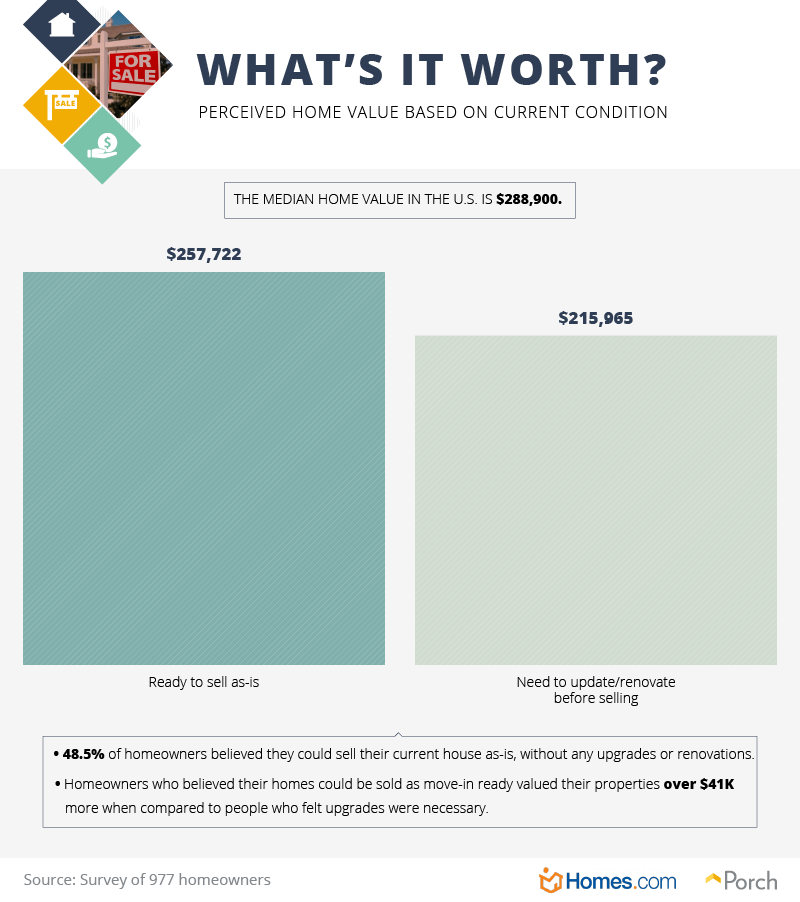

Across the U.S., the median price to buy a home is $226,800, and people who felt forced to perform renovations before selling estimated a much lower value on their own property. Compared to owners who thought their homes were worth an above-average $257,722 and planned to sell as-is, people investing in renovations estimated their property was worth nearly 18 percent less at $215,965.

Thankfully, if you’re looking to up the value of your home before selling but don’t have the time or resources to take on a major renovation project, there are other options to help make your house more enticing to potential buyers. Try making the space bigger or more attractive, or looking into making it more energy-efficient (and take advantage of tax credits along the way), smarter, or more low-maintenance for the new family.

Ranking priority renovations

When it comes to selling a house, there are certain rooms that can make or break the vision a potential buyer has of living in a space. It won’t matter how well-manicured your lawn is or how much square footage you’re offering if the kitchen is run-down or the bathroom elicits disgust.

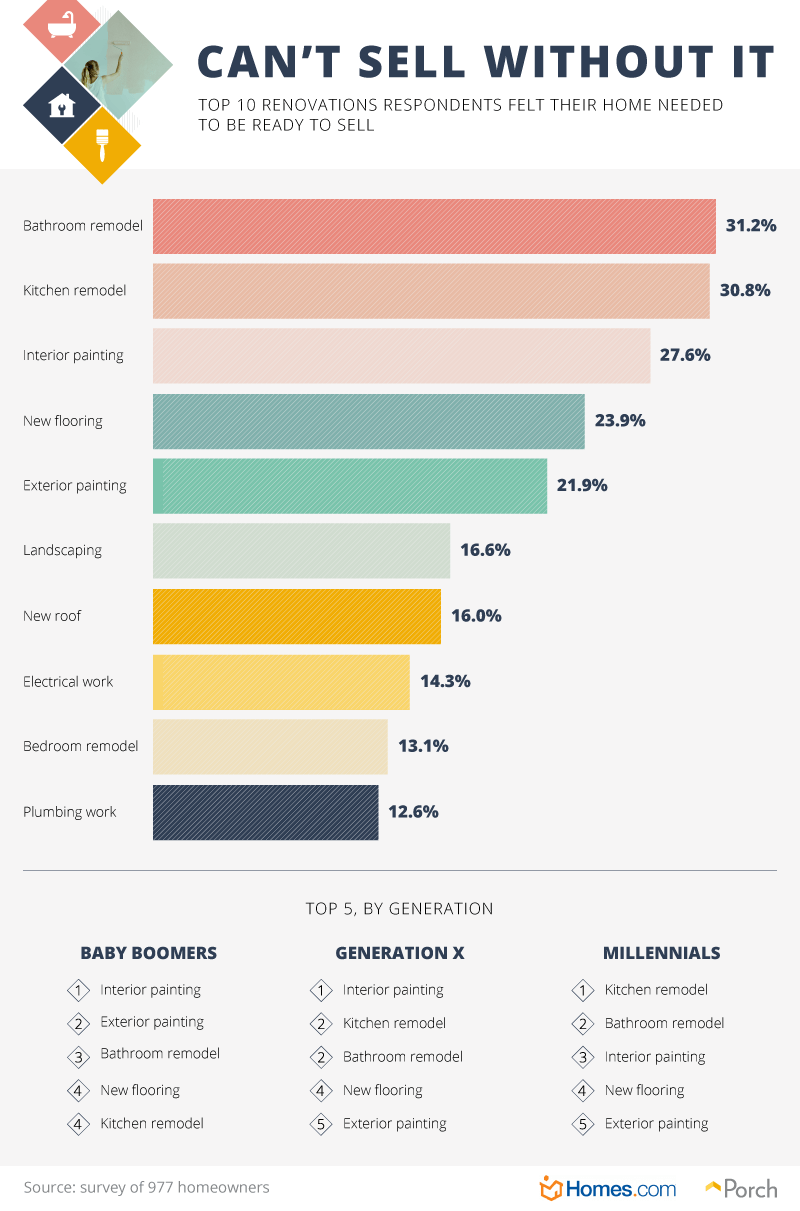

There are other rooms that can have a negative impact on buyers (including cramped closets or dark living spaces), but homeowners we surveyed believed a bathroom remodel (31.2 percent) or a full kitchen overhaul (30.8 percent) was crucial to entice buyers.

Of the homeowners we surveyed, millennials believed they needed to redo the kitchen before putting their home on the market. Instead, older generations looked to less expensive, more practical improvements. For both baby boomers and Gen Xers, it was interior painting pointed to as the most needed renovation. Rumors have been circulating for years that millennials aren’t buying homes, and while those assumptions aren’t universally true, millennials who are buying homes typically earn disproportionately higher incomes over their peers.

Getting your money back

It doesn’t take a certified accountant to tell you that doing home renovations can be expensive, and if you aren’t careful, you could end up spending hand over fist compared to your original estimations. According to one study, roughly 1 in 3 homeowners struggled to stay on budget for their home improvement projects, $2,000 for a laundry room to over $62,000 for full kitchen changes.

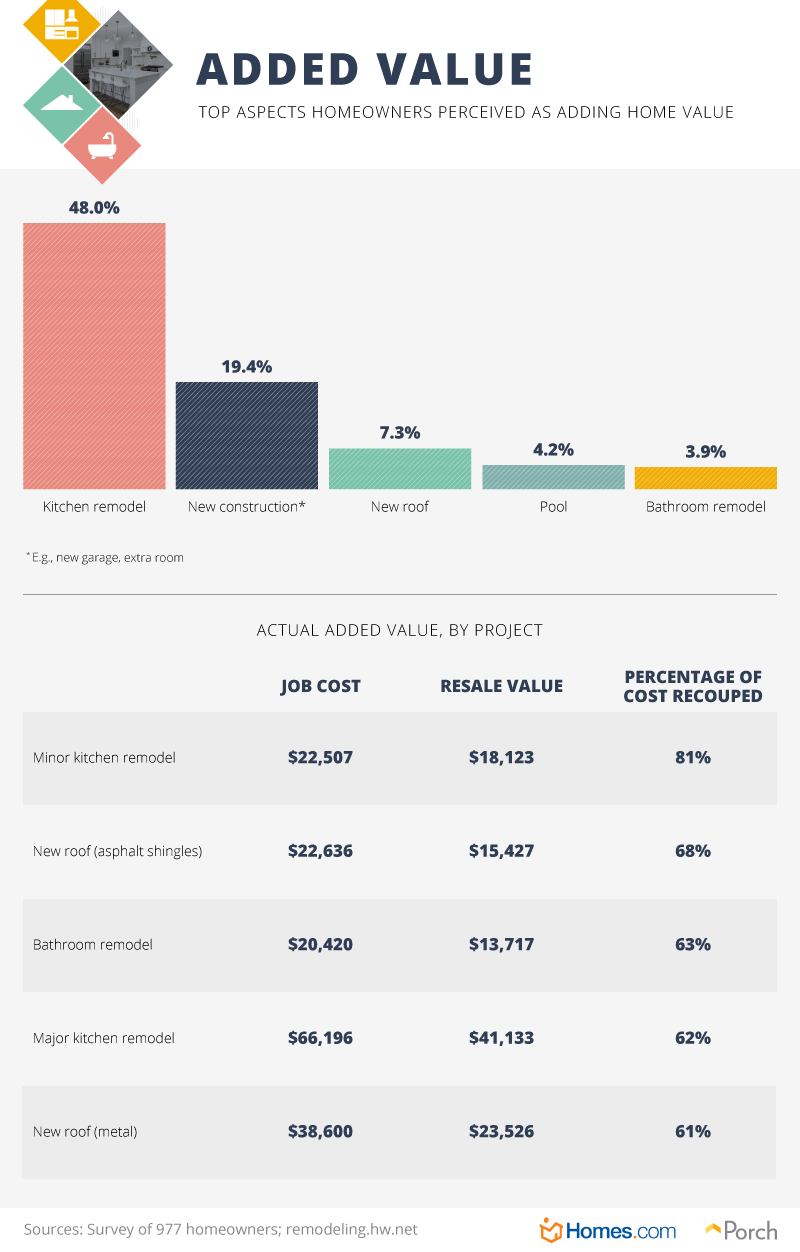

More than anything, 48 percent of homeowners we surveyed suggested a complete kitchen remodel would be the renovation to add the most value back into their home, though many don’t recoup the full expense. Doing smaller renovations to your kitchen could get you the most bang for your buck, costing homeowners an average of $22,507 and netting a return of $18,123 (81 percent). In contrast, a full kitchen overhaul cost homeowners we polled over $66,000 and netted just $41,000 back (62 percent) once the home was sold.

And if you absolutely have to put a new roof on your home, you may want to seriously consider your options before opting for one material over another. A metal roof may cost you more (over $38,000) and get you less for your efforts (61 percent) compared to installing an asphalt roof (68 percent).

Long-term commitments

If you’re a first-time homebuyer, there are certain long-term expenses that may come as a complete surprise. Replacing your appliances, repairing or replacing a damaged roof, and even having to install new HVAC units can give you a serious case of sticker shock. Still, it’s important to remember that these are standard home maintenance occurrences, and at some point or another, you’ll likely have to fork over the cash to take care of them.

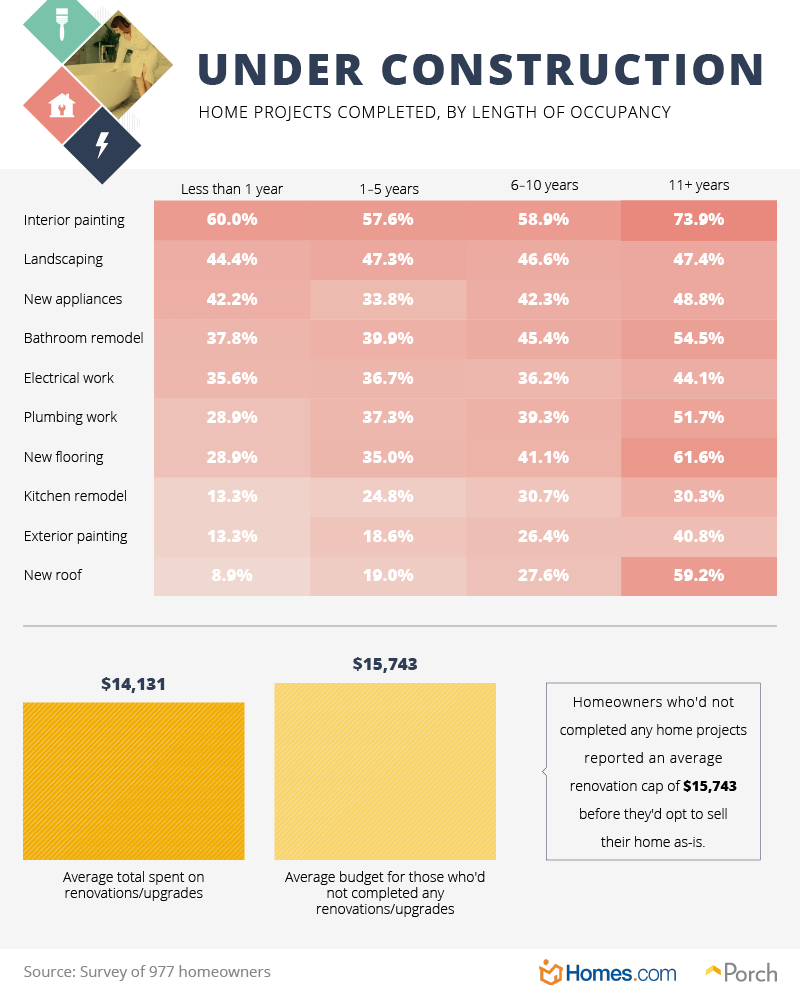

As we found, the longer you live in your home, the more obligated you may feel to take on renovations before passing the keys along to new residents. Including interior painting (74 percent), new flooring (62 percent), and a new roof (59 percent), if you lived in your home for 11 or more years, the odds are higher some home improvement work could be necessary.

Of course, you may not have to do anything at all to get your home appraised and on the market. On average, we found people were willing to spend a maximum of roughly $15,700 in renovation costs before they pulled the plug on upgrades and sold the property as-is. Similarly, homeowners we surveyed spent an average of just $14,000 to make some improvements on their home prior to sale.

Making the most out of your investment

Buying a house is typically one of the most complicated and expensive purchases any of us will ever make, but buying a home is also an investment. Just like the initial purchase, the decision along the way (or even when it comes time to sell and say goodbye) to pay for renovations is also viewed as an investment by many. As we found, the capital you put into upgraded parts of your home may not fully come back in the sale price if you aren’t careful, and some less practical upgrades are less desirable to older generations of homeowners despite what you might see on TV.

No matter what stage of remodeling you’re in—from the standard spruce-up to a full-on remodel—Porch is your go-to resource for professional support. Whether you’re looking for someone to help knock down some walls, put new walls up, or just repaint the walls that are already there, our network of Porch Services pros will help get the job done on time and on budget. And if you’re ready to move on to something new, Homes.com will help you find the perfect space to rent or buy. A smarter way to search for your next home, if you see something you like (whether or not it’s for sale), simply snap a picture and our Snap & Search technology will match you with properties in your area that fit the bill!

Visit us on the web at Homes.com or Porch today to learn more.

Methodology and limitations

The above study of 977 homeowners was conducted using Amazon Mechanical Turk Service. Of these respondents, 524 were women, 451 were men, and two identified as neither. 144 of the participants were baby boomers, 217 were from Generation X, 521 were millennials, and 36 were from a generation outside those. Data for the average cost of a project and the percentage of cost recouped come from remodeling.hw.net and can be found here. The cost of putting in a pool or for additional construction to a home was not covered in the dataset and thus was not represented with the other projects in terms of job cost, resale value, and percentage recouped.

Respondents had to be a current homeowner to qualify for this survey. All responses in the above study rely on self-reported data, which can be host to certain issues like telescoping and exaggeration. To ensure respondents were paying attention and not answering randomly, an attention-check question was used.

Fair use statement

Thinking about a massive design overhaul? You don’t have to worry about the resale value of sharing our research for any noncommercial use, just add a link back to this page in your story so our contributors get the best return on investment for their work.

Sources

- https://www.investopedia.com/personal-finance/how-set-budget-your-first-home/

- https://www.thespruce.com/smart-remodels-that-recover-their-costs-4121074

- https://www.nerdwallet.com/blog/mortgages/how-to-increase-home-value/

- https://www.forbes.com/sites/samanthasharf/2019/07/08/yes-millennials-really-are-buying-homes-heres-how/#1b558b764504

- https://www.cnbc.com/2017/05/10/how-to-remodel-without-wrecking-your-finances.html

- https://www.hsh.com/homeowner/home-maintenance-checklist.html