When you’re purchasing a home, signing on the dotted line can be one of the most exciting moments of your life. With images of cozily decorated rooms, conversation-worthy art, and candlelit dinner parties swirling around your mind, it’s all too easy to push an entirely different set of images into the background.

Said images include busted pipes, hail-pelted windows, and roofs crushed under the weight of a fallen tree. For these reasons and more, around 85 percent of American homeowners have chosen to purchase an insurance policy for their home—a wise choice given the range of liabilities and risks you take on when you own property.

We wanted to understand what types of claims were most common in the U.S. and whether the average insurance claim was a painful or painless process for most people—so we surveyed over 1,000 homeowners to learn more. Keep reading so that you know what to expect if and when you file a claim of your own.

Assessing the damage

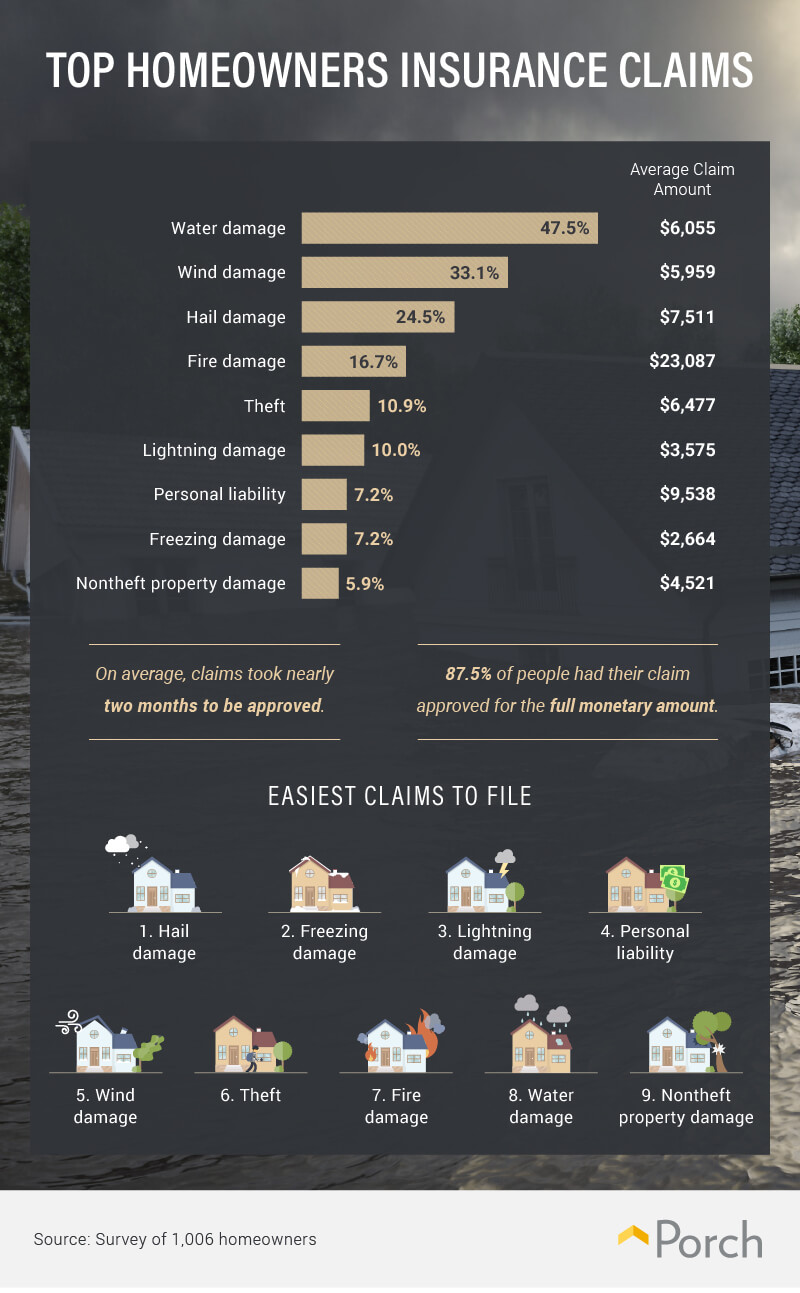

When it rains, it pours: The most common insurance claim by a fairly wide margin was water damage, with 47.5 percent of respondents having dealt with this type of issue. The average amount associated with water damage claims was $6,055.

A recent report that analyzed American insurance data from the past decade or so found that water damage issues have been on the rise: Between 2013 and 2017, 2.05 percent of homeowners filed a water damage claim, up from 1.44 percent between 2005 and 2009. The hypothesis is that aging equipment, second-story washing machines, and faulty connections are at least partially to blame. To nip any issues in the bud before they reach critical mass, you should know when to call a plumber and which early warnings to look out for.

The second and third most common claims were wind damage (33.1 percent) and hail damage (24.5 percent), but fire damage in fourth place (16.7 percent) racked up the highest average claim amount at over $23,000. On average, people’s claims took nearly two months to be approved, and the easiest claims to file were hail, freezing, and lightning damage. The latter two were also the lowest average claim amounts, potentially leading to a more fast-tracked experience.

If at first you don’t succeed…

Luckily for our respondents, the majority (79.6 percent) never had an insurance claim denied. However, that still means over 20 percent were left high and dry, having to take alternative measures to pursue their claim. The most denied claims were water, wind, and hail damage. If you’re looking to file with your insurance company and want to leave no stone unturned, the Insurance Information Institute recommends following this step-by-step process.

Luckily for our respondents, the majority (79.6 percent) never had an insurance claim denied. However, that still means over 20 percent were left high and dry, having to take alternative measures to pursue their claim. The most denied claims were water, wind, and hail damage. If you’re looking to file with your insurance company and want to leave no stone unturned, the Insurance Information Institute recommends following this step-by-step process.

Following a claim denial, the majority of respondents split into two camps at a nearly equal rate: Hiring a home insurance adjuster (43.4 percent) or disputing the claim themselves (41 percent). Another 15.6 percent decided to let it be and not pursue further action. Bear in mind that there’s more than one way to approach a denied claim—you just need to find one that strikes the right balance for your situation.

While the average disputed claim took close to five months to be resolved, nearly three-quarters were approved in the end, making it well worth the wait (and effort) for most homeowners.

Repair recommendations

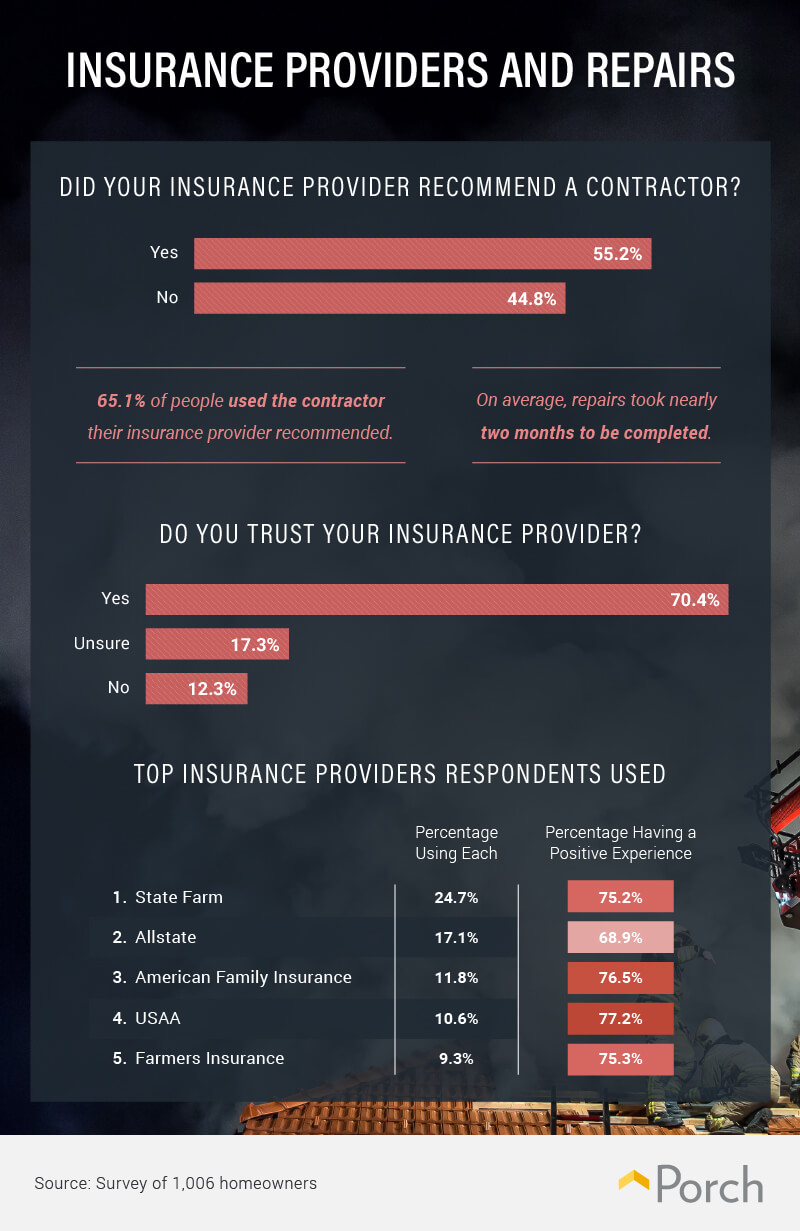

In the wake of a disaster, just over half of respondents were recommended a contractor to get the job done, and people took that recommendation 65.1 percent of the time. That might be because nearly three-quarters of respondents said they trusted their insurance provider (compared to 17.3 percent who were unsure, and 12.3 percent who said they did not). Regardless of whether you get a recommendation or seek out a contractor on your own, you should know exactly what to look for before you hire someone to work on your home.

In the wake of a disaster, just over half of respondents were recommended a contractor to get the job done, and people took that recommendation 65.1 percent of the time. That might be because nearly three-quarters of respondents said they trusted their insurance provider (compared to 17.3 percent who were unsure, and 12.3 percent who said they did not). Regardless of whether you get a recommendation or seek out a contractor on your own, you should know exactly what to look for before you hire someone to work on your home.

State Farm was the most popular insurance provider among respondents, serving just under a quarter of our surveyed population. Allstate and American Family came second and third, respectively. Overall, people were quite satisfied with the service they received: Over 75 percent of State Farm, American Family, USAA, and Farmers customers said as much. Meanwhile, 68.9 percent of Allstate clients said they had a positive experience with their provider—a lower score than other companies, but a solid one nonetheless.

All’s well that ends well

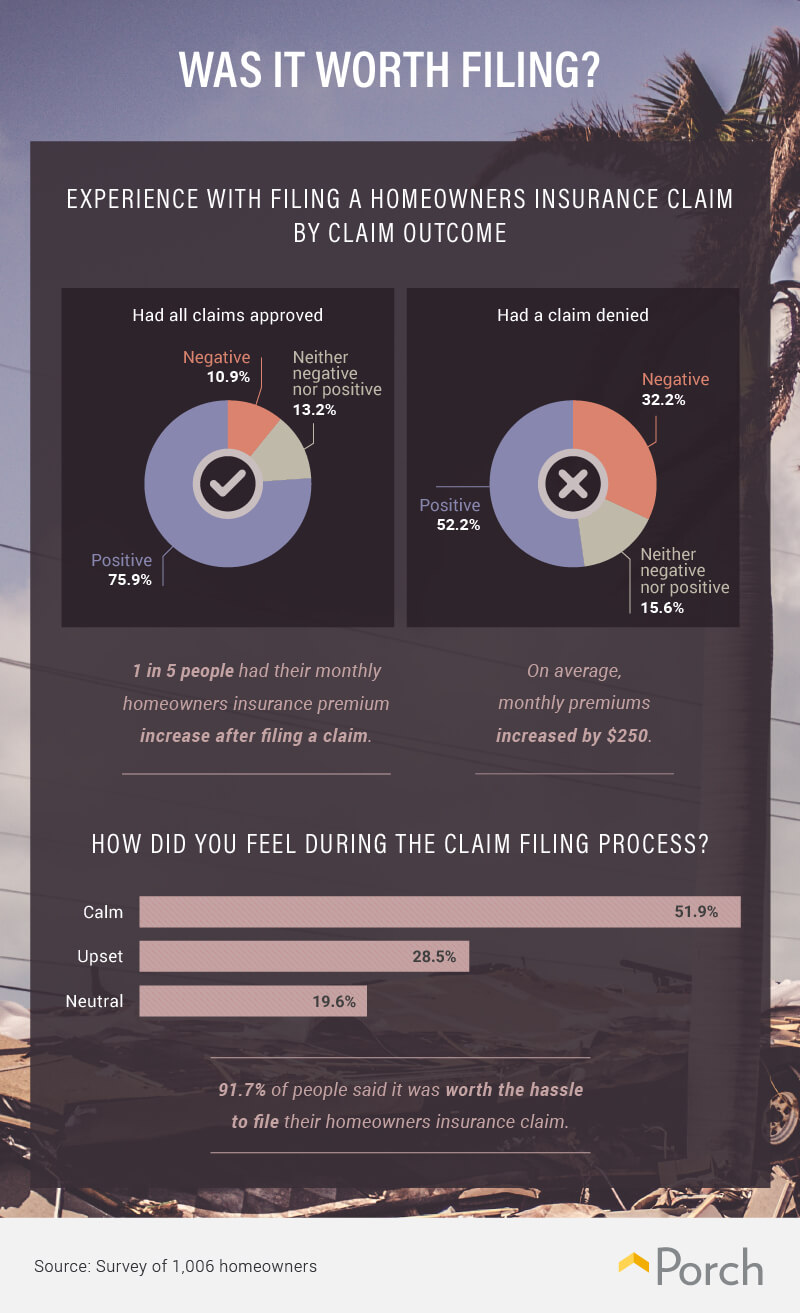

No matter if their claim was accepted or denied, the majority of respondents said they had a positive experience filing with their insurance company. Understandably, a higher portion of homeowners who had their claims approved felt this way (75.9 percent versus 52.2 percent), but the sentiment was generally positive regardless.

Following a claim, 1 in 5 people saw their monthly premium go up, with an average increase of $250. It’s always worth exploring certain avenues to see if you can reduce your premium—regardless of whether it has been subject to a recent increase—such as bundling home and auto, learning whether your provider offers longevity discounts, or increasing your deductible if you believe yourself to be a low-risk client.

Overall, people reported feeling calm (51.9 percent) during the claim filing process, but a significant number of respondents identified as upset (28.5 percent). Another 19.6 percent felt neutral. However, no matter the hoops they had to jump through when dealing with their insurance provider, an impressive 91.7 percent said the hassle was well worth it, and they were glad they filed.

Accidents happen—and we have the solution

In the U.S., water damage claims were the most filed among homeowners, while fire damage racked up the largest bills by far. While most people never had a claim rejected by their insurance provider, nearly all of those who did said it was worth the effort to dispute it. Overall, people were surprisingly trusting of their providers and frequently chose to hire the contractors recommended by their insurance company.

However, if you prefer taking matters into your own hands when it’s time to deal with house-related damage, you can trust Porch to connect you with a repair expert. Our vetted contractors come with reviews and ratings so that you can make an informed decision about what is arguably your most valuable asset. From electrical repairs to roofing and HVAC, visit Porch to find your perfect contractor.

Methodology and limitations

To collect the data shown above, we surveyed 1,006 homeowners. To qualify for this survey, respondents were required to have filed a homeowners insurance claim. Of the 1,006 respondents, 602 were first-time homeowners, and 404 were not. The respondent pool was 51.1 percent female and 48.9 percent male. The data were calculated to exclude outliers. We did this by finding initial averages and standard deviations for the data. Then, the standard deviation was multiplied by two and added to the initial average. Any data point above the calculated number was then excluded from the data. Because the survey relies on self-reporting, issues such as telescoping and exaggeration can influence responses. An attention-check question was included in the survey to make sure respondents did not randomly answer.

Fair use statement

If you choose to share this article for noncommercial purposes, we have one small thing to ask of you: Please link back to the original piece, so credit is given where credit is due, and everyone can get the full story!