What do you really need to know to buy a home? First-time homebuyers might say you don’t need experience. In fact, one-third of home purchases in recent years were byfirst-time buyers, and most of these first-timers were younger millennials. But older and more experienced homebuyers may tell you there’s a lot to know before buying a home.

To find out what you need to know to buy a home, we quizzed homeowners both young and old on their knowledge of the homebuying process. We asked them about real estate agents, credit scores, and the mortgage process, and then we broke down our results by subject and generation to see where knowledge gaps may lie. We found that millennials may bebuying the most homes, but their knowledge of the process lags behind that of older generations. Keep reading to find out more.

The results are in

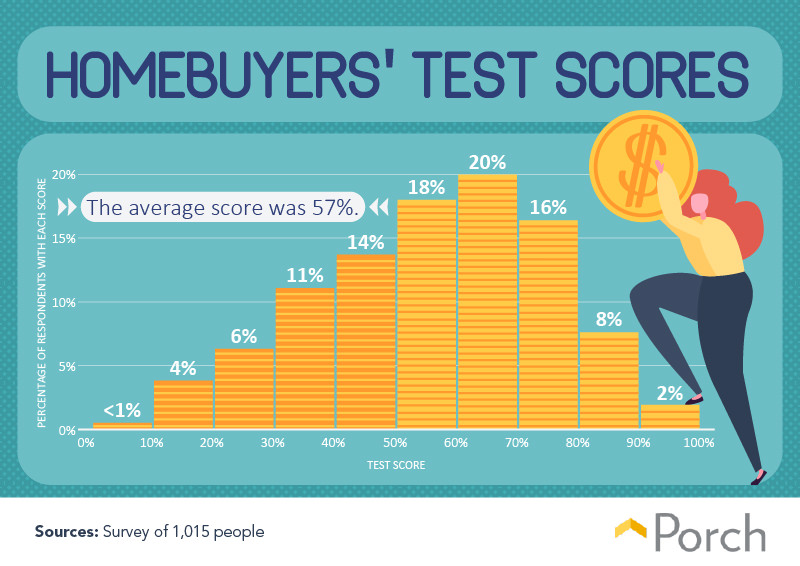

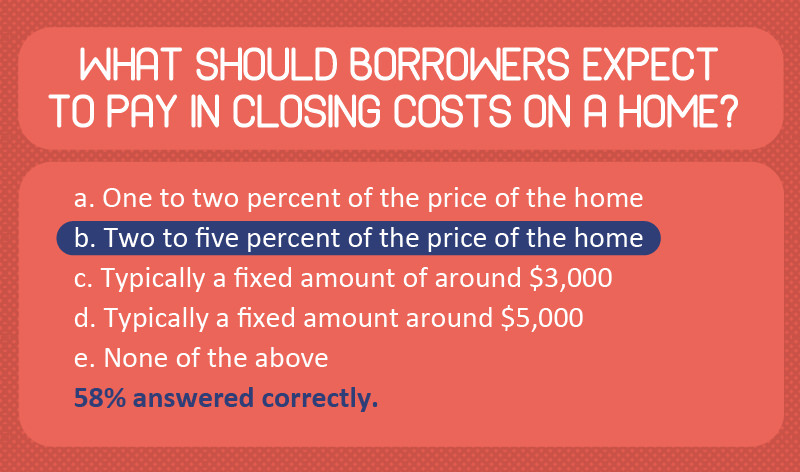

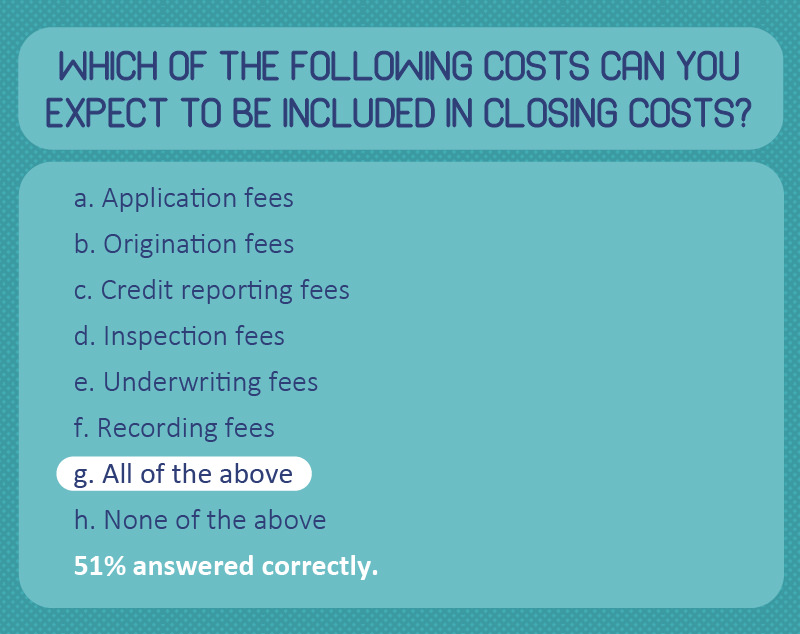

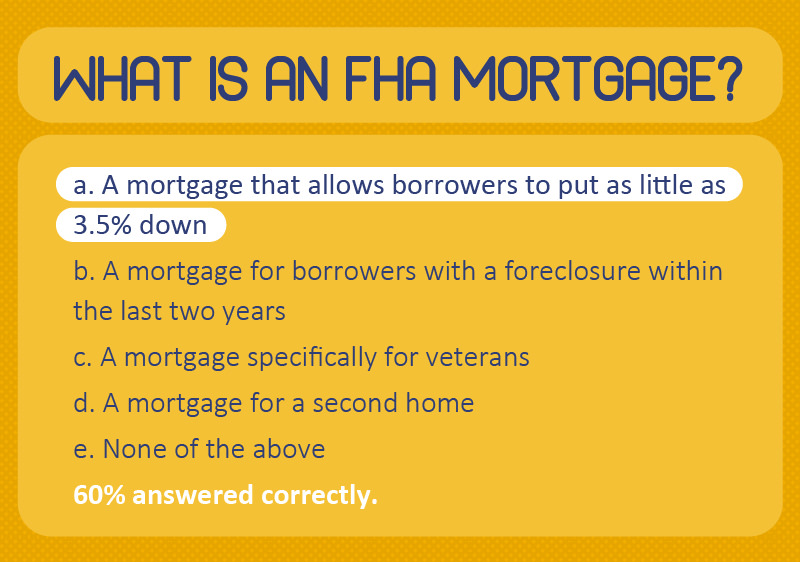

The average score on our homebuyer quiz was 57 percent. Only 2 percent of respondents scored between 90 and 100 percent on the quiz, with 8 percent scoring between 80 and 90 percent—that would equate to only 10 percent of all respondents earning a “B” or better. The good news is that less than 1 percent scored 10 percent or worse. In fact, the most common score fell between 60 and 70 percent. Not a bad start, but it appears there are still some homebuying knowledge gaps to fill.

In fact, the most common score fell between 60 and 70 percent. Not a bad start, but it appears there are still some homebuying knowledge gaps to fill.

Where do homebuyers go when they need information on buying a home? The majorityturns to online websites, according to the National Association of Realtors. If they aren’t looking online for answers, homebuyers are likely asking real estate agents for help.

Owners vs. renters

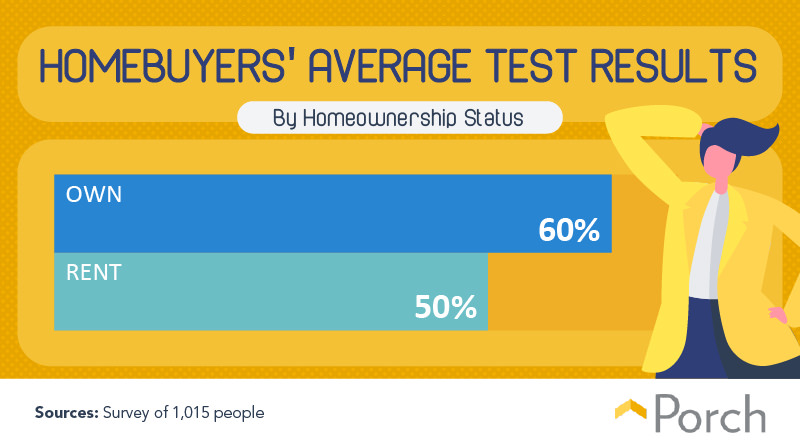

As one would expect, homeowners know a bit more about buying a home than renters. Nothing beats real-world experience where learning is concerned. Homeowners scored 10 percentage points higher on our quiz than renters.

As one would expect, homeowners know a bit more about buying a home than renters. Nothing beats real-world experience where learning is concerned. Homeowners scored 10 percentage points higher on our quiz than renters.

While we expect renters to be less aware of the nuances of homebuying than people who have previously purchased a home, renters averaged a 50 percent on our quiz, getting half the questions wrong. Homeowners, by comparison, only got 60 percent correct.

Among those homeowners,nearly 60 percent said they were “very or extremely” informed about the mortgage process when purchasing their most recent home. While we know not all homebuying processes are the same, we do believe some people may have overestimated their knowledge.

Generational knowledge gaps

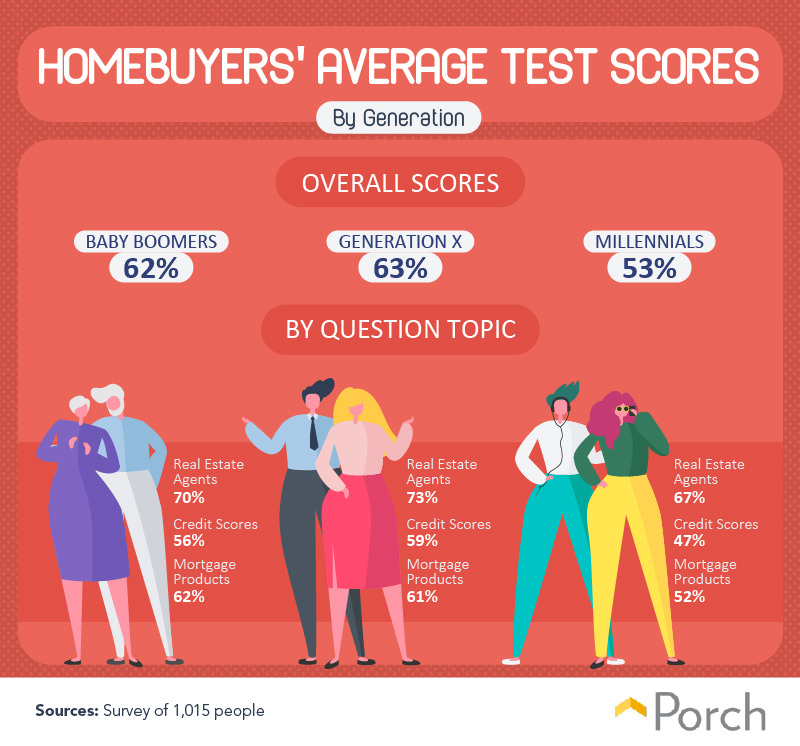

While baby boomers and Gen Xers were similar in their homebuyer expertise, Gen Xers performed 1 percentage point better, getting 63 percent of the questions correct. Still,Gen Xers took the lead in most categories of questions. Gen Xers were the most knowledgeable about real estate agents and credit scores. Meanwhile, baby boomers knew more about mortgage products.

While baby boomers and Gen Xers were similar in their homebuyer expertise, Gen Xers performed 1 percentage point better, getting 63 percent of the questions correct. Still,Gen Xers took the lead in most categories of questions. Gen Xers were the most knowledgeable about real estate agents and credit scores. Meanwhile, baby boomers knew more about mortgage products.

Millennials, despite being the largest group of homebuyers—theybought more homes than any other generation in 2018—were the least knowledgeable about homebuying. They scored at least 9 percentage points lower than baby boomers and Gen Xers, on average, and upward of 10 percentage points lower in individual categories. Millennial knowledge most lagged behind that of their elders in terms of credit scores.Millennials scored 9 percent lower than baby boomers on credit score-related questions and 12 percent lower than Gen Xers.

For all three generations, real estate agents were the most well-informed category, while credit scores proved to be the biggest challenge.

What have love and money got to do with it?

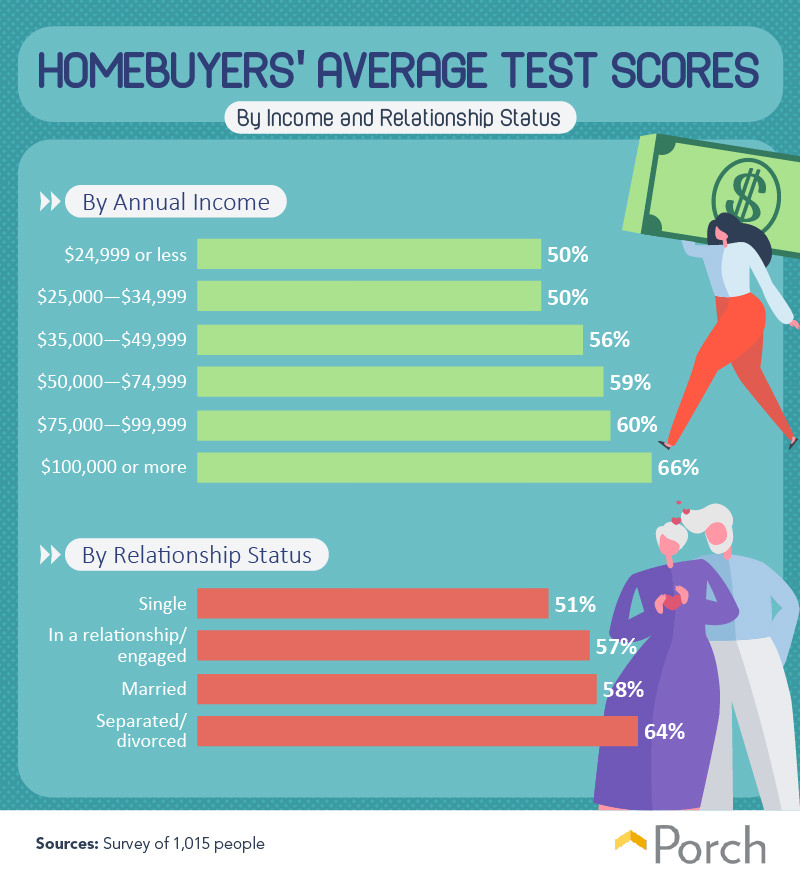

When we broke down our quiz results down by annual income and relationship status, some interesting trends emerged. For instance, income played a clear role in how knowledgeable people were about homebuying. The higher their income, the more people knew about homebuying.Respondents earning $100,000 or more annually scored 16 percent higher on our homebuyer quiz than people earning less than $25,000 per year.

When we broke down our quiz results down by annual income and relationship status, some interesting trends emerged. For instance, income played a clear role in how knowledgeable people were about homebuying. The higher their income, the more people knew about homebuying.Respondents earning $100,000 or more annually scored 16 percent higher on our homebuyer quiz than people earning less than $25,000 per year.

This may be related to our finding that homeownership increases homebuyers’ knowledge. Higher earners are statistically more likely to own or have owned a home. Those in the top 20 percent of income have a homeownership rate of 87 percent, compared to only 30 percent for people in the bottom 20 percent of income,according to Zillow.

Those in the top 20 percent of income have a homeownership rate of 87 percent, compared to only 30 percent for people in the bottom 20 percent of income,according to Zillow.

Another interesting finding from our quiz was the link between relationship status and homebuyer expertise. Single respondents were the least knowledgeable about homebuying topics. As they became more committed—moving up from single to engaged to married—their knowledge increased. But no one knew more than divorced or separated respondents about homebuying. These results have more to do with experience: The divorce rate among adults aged 65 and olderhas tripled since 1990. If you’re more likely to be divorced at 65, you’re also more likely to have gone through the homebuying process.

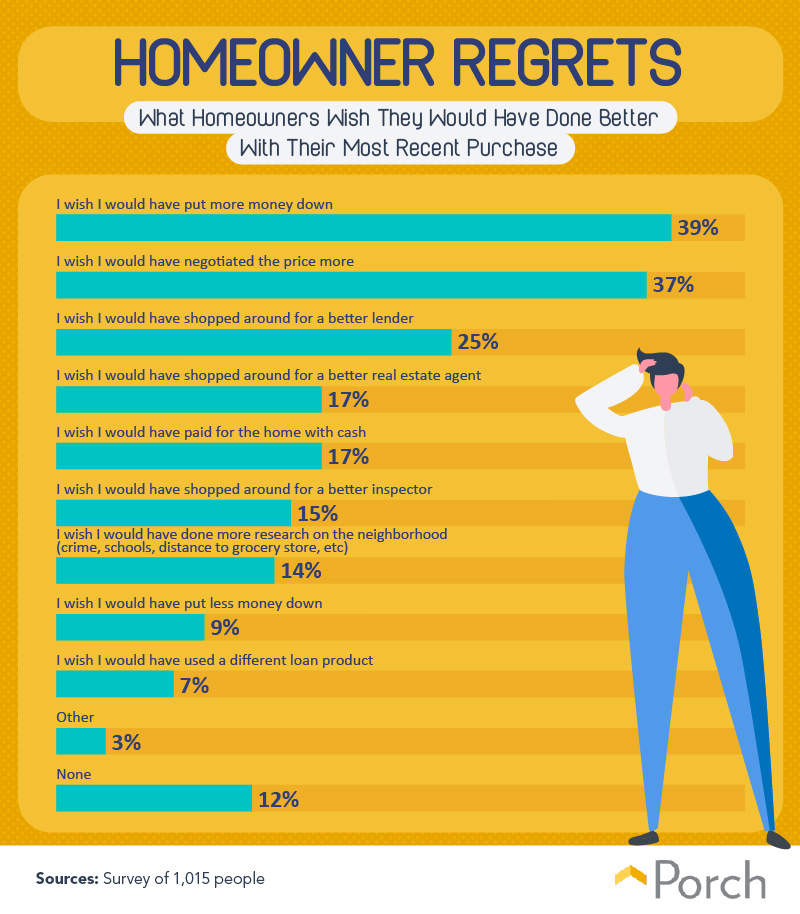

What we’d do differently if we could

We rounded out our quiz by asking homeowners what they would do differently if they could go through their most recent home purchase again.The No. 1 regret among homeowners was not putting more money down on their most recent home purchase. Close behind this homeowner remorse was not having negotiated hard enough on the purchase price. That said, 9 percent of homeowners wished they’d put less money down. Another 17 percent of homeowners said if they could do it again, they’d pay cash for their home.

That said, 9 percent of homeowners wished they’d put less money down. Another 17 percent of homeowners said if they could do it again, they’d pay cash for their home.

Homeowners regret their choice of lender more than their choice of real estate agent:25 percent of homeowners wished they’d shopped around for a lender before buying, but only 17 percent wished they’d found a better real estate agent. Maybe a different lender would have suggested a different loan product, which could alleviate a common regret among 7 percent of homeowners: that they chose the wrong loan product to buy their most recent home.

A happy 12 percent of homeowners would change nothing about their most recent home purchase. To them, we tip our hats.

Are you smarter than you think?

So how would you do on our quiz? Yes, we’ve already given you a preview of some of the questions, but feel free to take the full quiz if you’re curious about your homebuying knowledge.

Knowledge is power

Whether you’re shopping for a home or a screwdriver, it’s helpful to be a knowledgeable consumer. You want to know you’re getting a good product and a good price. Homebuyers may turn to real estate agents for help, but homeowners turn to Porch.

From the day you move in, we’re here to help. Just tell us what you need done—whether it is installing a roof or fixing your microwave—and we’ll match you with a licensed professional in your area who can get the job done for the right price. We make everything transparent with visible credentials and clear pricing. With Porch, you’ll always be a knowledgeable consumer.

Methodology and limitations

For our homebuyer quiz, we surveyed 1,015 people about their homebuying histories. Of everyone surveyed, 529 were men, and 485 were women, with one person selecting another option. 584 owned single-family homes, 201 owned apartments or townhouses, 193 rented apartments or condos, and the rest selected other options.

While we understand that the quiz we administered is not a peer-reviewed or formalized survey, we think it is an accurate assessment of homeownership knowledge. That said, it shouldn’t be treated as anything more than for entertainment, and more research would have to be done for further claims. Additionally, since it was a survey, we understand that biases common to any survey may be present, like recency or telescoping. We did, however, make every effort to show the data fairly.

Fair use statement

Want to share what you learned? We’d love it if you did. We just ask that you use our content for noncommercial purposes only and link back to this page so that credit can be given where it’s due. Thank you.