Real estate and housing, in particular, can be a lucrative investment. Single-family homes in the U.S. have nearly doubled in value during the last two decades, despite the Great Recession and mortgage crisis in the late 2000s. And with experts predicting a shift to a buyer’s real estate market in 2020, many may consider investing in a new home in the years to come.

But before you make any investment, it’s important to weigh your options. Is a home really the best place to invest right now? We were curious how good of an investment U.S. homes are and how they compared to investing elsewhere, such as the stock market. To answer these questions, we surveyed around 1,400 people about the future value of various investments. We then compared their responses to past investment performances. Keep reading to see what we found.

A Glimpse Ahead

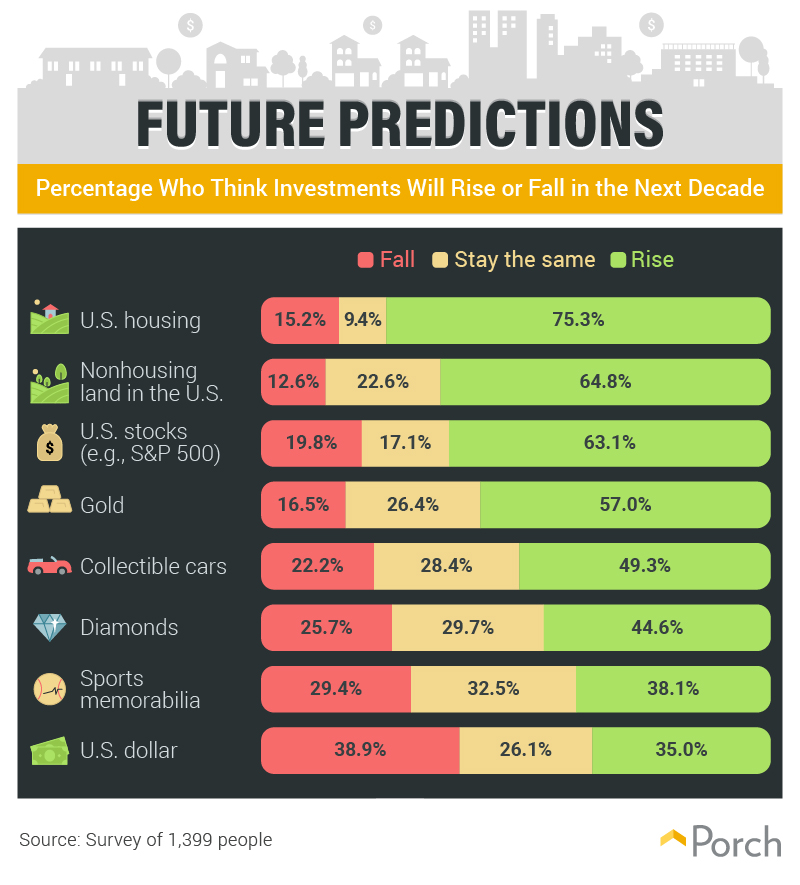

The first question we asked was what people thought lay in store for eight of the most popular investments. Did they think these investments would rise in the next 10 years, stay the same, or fall?

Our results indicate that people were the most optimistic about home values rising. Over 75 percent of people said houses would rise in value in the next 10 years, while only 15 percent said they thought housing prices would decline. Respondents were also optimistic about the value of nonhousing land rising in the next decade. Only about 13 percent of respondents thought land values would decline between now and 2029.

Compare this to the U.S. dollar, which people were the least optimistic about. There was a nearly an even split between those who said they thought its value would increase versus decline, but more people said they thought the value of the U.S. dollar would decline in the next 10 years.

People were even more optimistic about the value of sports memorabilia than the U.S. dollar. And despite fears from some that a recession may be nearing, 63 percent of people thought stock values would rise in the next decade.

Future Pricing

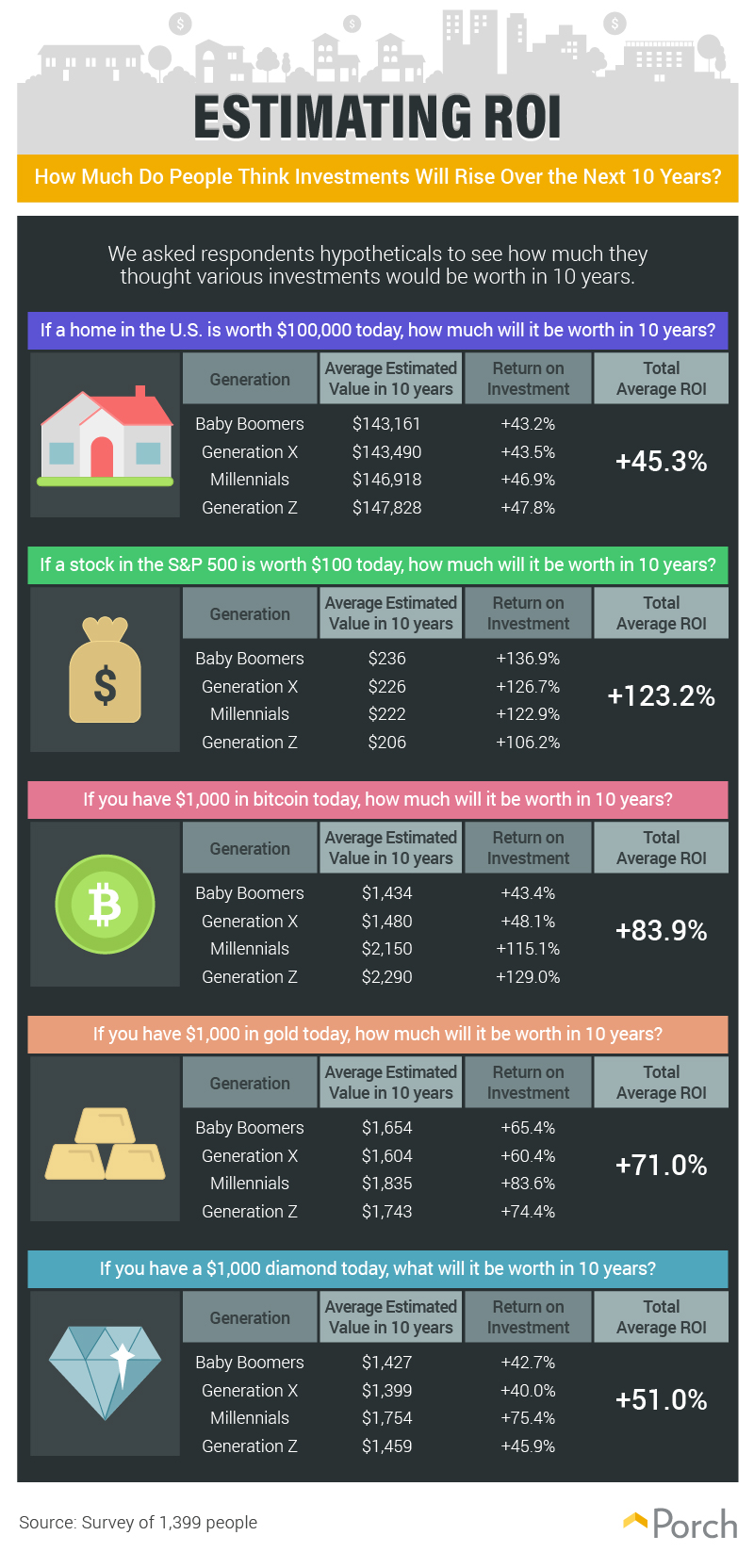

To get a clearer idea of how much people think investments will rise over the next decade, we asked our survey respondents hypothetical questions about each investment’s value. Despite the majority of respondents believing home values would rise in the next 10 years, those values increased less than any other investment, on average.

People thought home values in the U.S. would rise 45.3 percent in the next decade. A pretty fair estimate, given that housing prices are up over 50 percent since the bottom of the financial crisis.

While people remain optimistic about the future of home values, it pales in comparison to their optimism for stock investments. Across all generations, people believed stock in the S&P 500 would more than double in the next 10 years. Interestingly, while baby boomers were the least optimistic about the future of home values, they were the most optimistic about how much stock in the S&P 500 would be worth in 10 years. Gen Zers, on the other hand, were the most optimistic about home values appreciating but the least optimistic about stock investments.

The biggest generational divide on the future of investments was with bitcoin. Every generation believed bitcoin would continue to rise in the next 10 years, but the younger generations were over twice as optimistic as the older ones. Baby boomers and Gen Xers estimated $1,000 in bitcoin would rise by less than 50 percent in 10 years. Meanwhile, millennials and Gen Zers predicted bitcoin would more than double, rising over 115 percent and 129 percent, respectively.

Baby boomers and Gen Xers said they would rather put their money in gold than bitcoin, and all generations agreed gold was a better investment than diamonds.

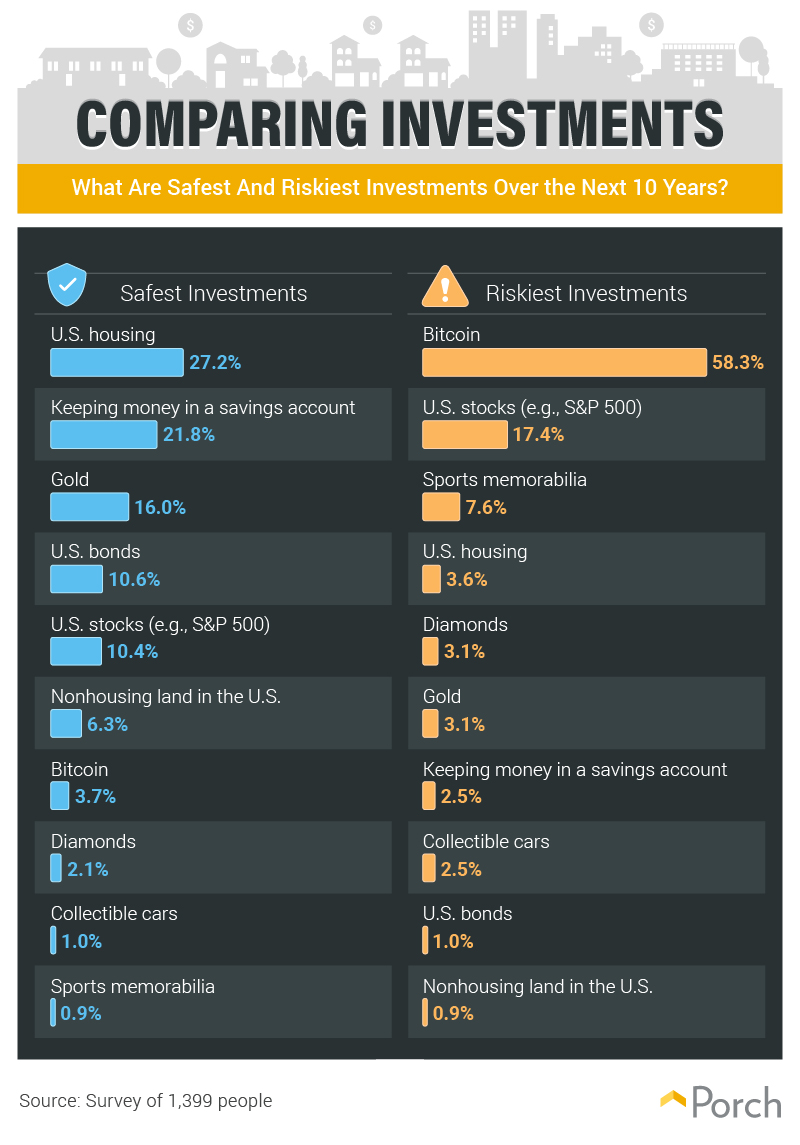

Safest and Riskiest Investments

Investing is a juggling act between risk and reward: More risk should translate to a higher reward over time, but it can also result in a greater loss and more variable outcomes. Of the 10 investments we asked our respondents about, people thought housing in the U.S. would be the safest investment in the next 10 years—even safer than keeping money in a savings account.

Bitcoin, on the other hand, was seen as the riskiest investment by over 58 percent of respondents.

Bought to last?

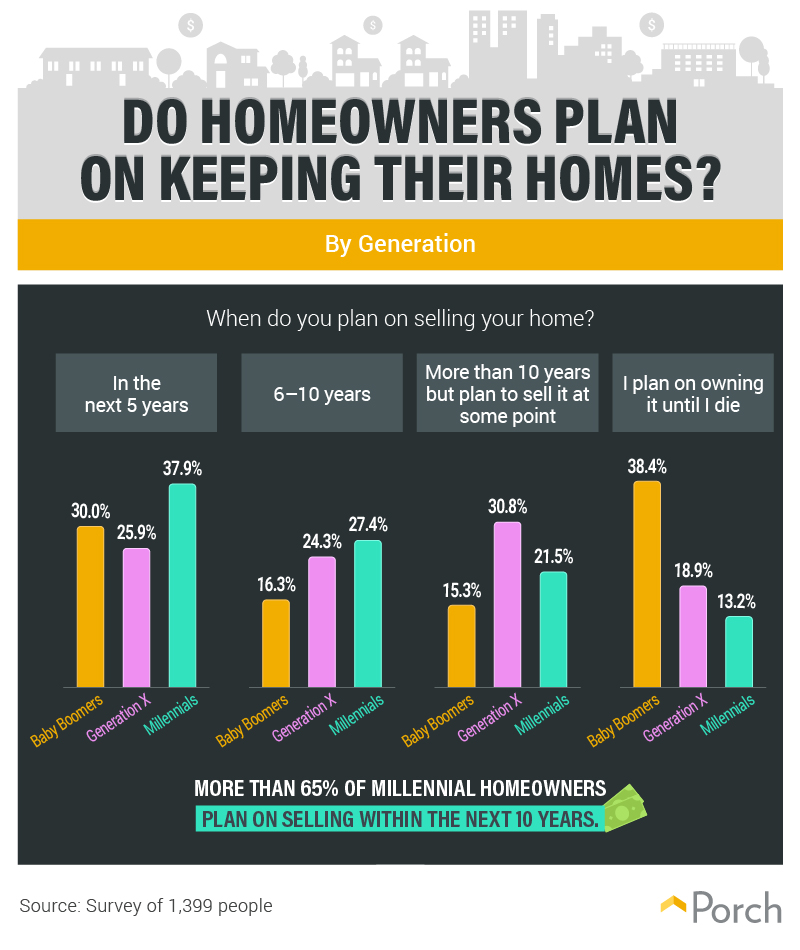

With such optimism about the rising value of homes in the U.S., we wondered how many people planned to put their faith to the test. We asked each generation when they planned to sell their current home.

More than 65 percent of millennial homeowners said they plan to sell their home in the next 10 years. Despite being the most likely to sell sooner rather than later, millennials are actually moving less often than previous generations did at their age.

Baby boomers were the most likely to plan to own their home for the rest of their lives, while Gen Xers were the most likely to sell after at least 10 years had passed.

Housing over Time

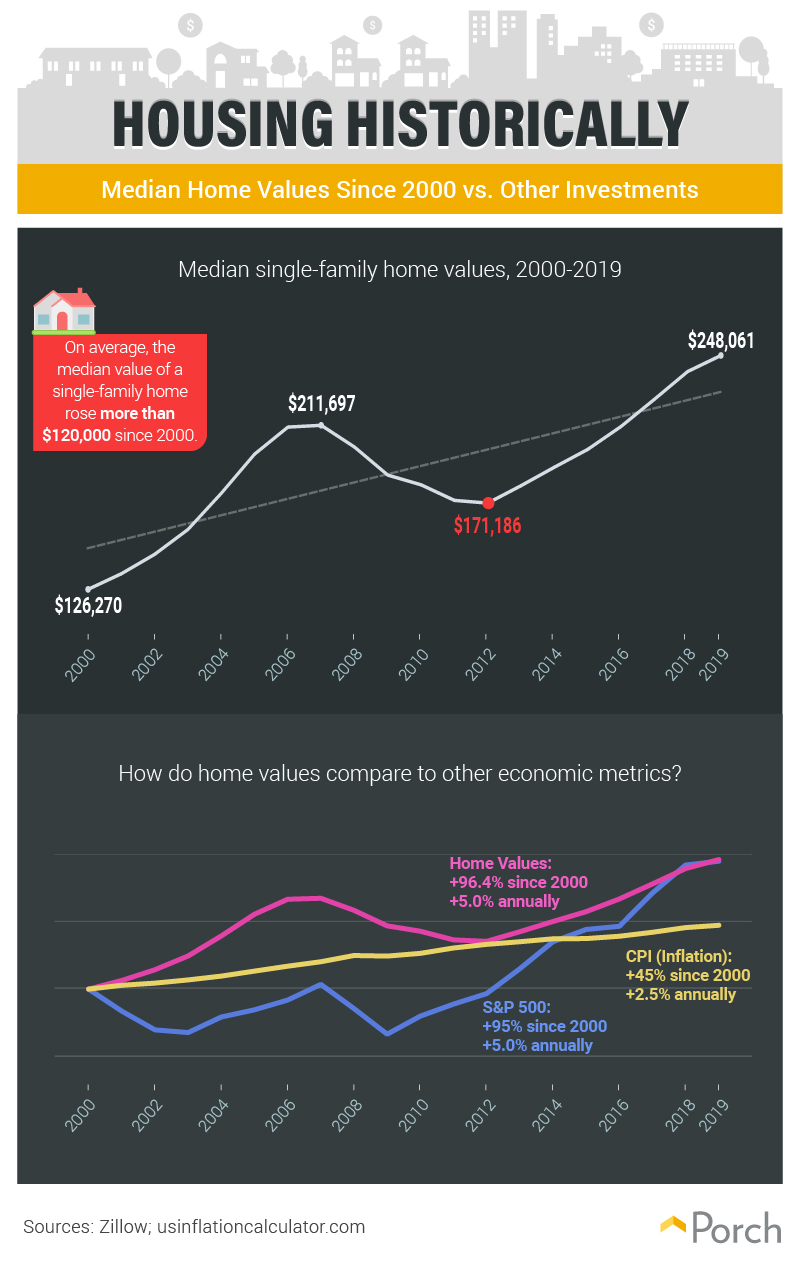

We’ve looked at what people think various investments will do in the future, but how do our expectations compare to reality? People had faith in U.S. housing being a strong investment in the future, and based on past housing data, they had a good reason to believe so.

Historically, housing has been a lucrative investment. The median value of a single-family home increased more than $120,000 since 2000. And it’s been a pretty steady climb, except for the Great Recession. While the housing bubble of 2006 and 2007 took a chunk out of home values at the time, experts say we aren’t likely to experience a similar housing crisis.

Home values also compared favorably to other investments, with U.S. home values continuing to outpace inflation even through the housing crisis. They also experienced a much slower decline than the S&P 500 during the Great Recession. Both home values and the S&P 500 averaged a 5 percent annual growth since 2000 but, ultimately, home values slightly outpaced the S&P 500. U.S. home values have grown 96.4 percent since 2000 compared to a 95 percent growth for the S&P 500 during that period.

Regional Differences

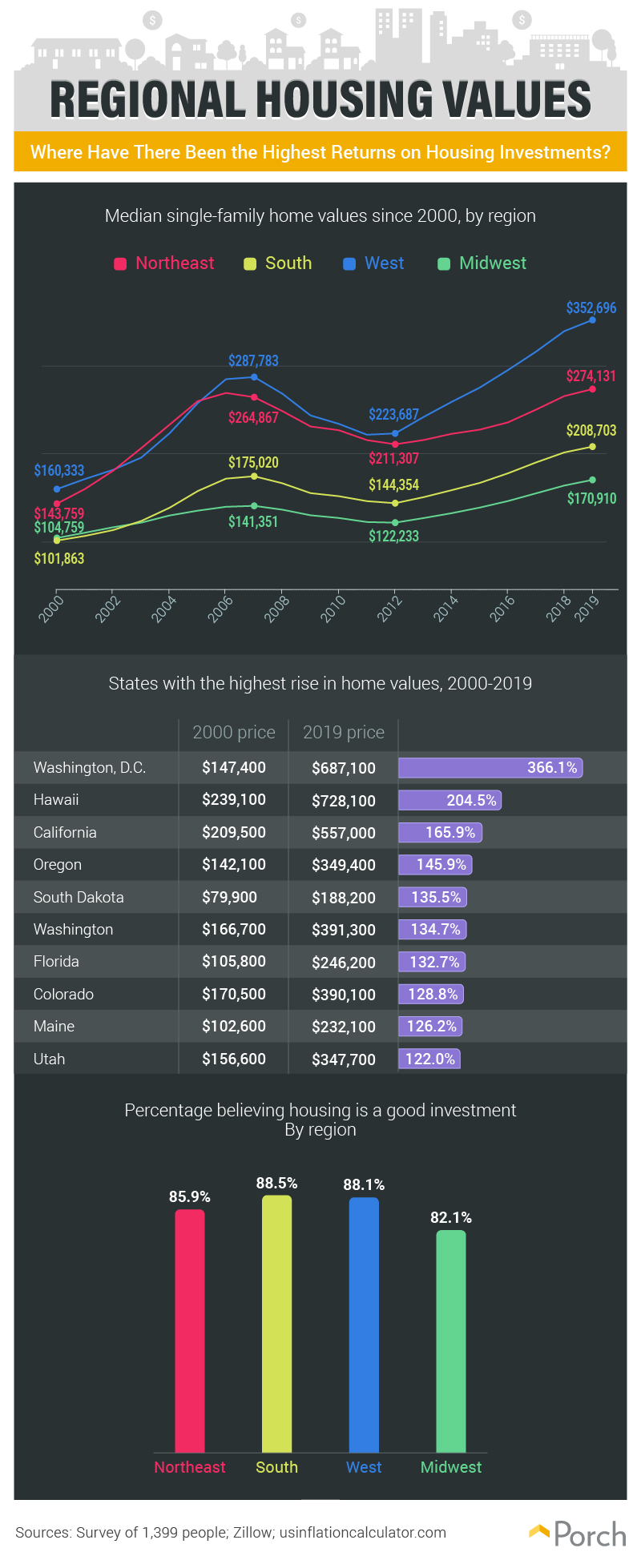

As any real estate agent will tell you, location matters to home values. Location is even more important when you view your home as an investment. The most lucrative region to own a home between 2000 and 2019 was the West, where home values appreciated by 120 percent. The South was the second most profitable, with home values rising by 105 percent. In the Northeast, they grew by almost 91 percent. Meanwhile, the Midwest experienced more modest growth in home values of 63 percent.

While the West won the home value race overall, when broken down by state, it was the Northeast that took the crown. Washington, D.C., experienced the greatest home value growth since 2000, with home values rising by 366 percent. The next best state to have owned an investment home in the past two decades was Hawaii, where home prices grew by over 200 percent.

When we broke down the percentage of people who said housing was a good investment by region, we found a nearly even split. Southerners were marginally more likely to view housing as a good investment, while Midwesterners were the least likely.

City differences

Finally, we took our research to an even more granular level by looking at housing prices across U.S. cities. Unsurprisingly, Washington, D.C., had the greatest growth. D.C. home values rose more than 100 percentage points more than any other U.S. city since 2000.

After D.C., the list of cities with the highest rise in home values was largely dominated by California—18 of the cities with the highest rise in home values since 2000 were in California. A few notable exceptions were Jersey City, New Jersey, which experienced the third-highest rise in home values since 2000, and Bellevue, Washington, where home values rose by 233 percent.

To invest or not to invest?

There’s no question about it: Housing can be a good investment. Home prices in the U.S. outpaced the S&P 500 over the past two decades, and according to our survey, people expected home prices to keep chugging along. Whether you’re buying a home as an investment or purely for its use, a lot goes into making a house a home—especially if you’re hoping to sell it at a profit later.

At Porch, we want to make sure you get the best ROI on any home project you undertake, from carpentry to winterization. We can even help you get the best price and professional help to turn your house into a lucrative investment.

Methodology and limitations

To compile the data shown above, we surveyed 1,399 people on their attitudes and outlooks toward the housing market. The survey was conducted as a larger exploration of investment attitudes focused on generational differences. Our surveyed population was comprised of 254 baby boomers, 279 Gen Xers, 661 millennials, 194 Gen Z, and 11 people who were from other generations.

As with any survey, respondents may have been biased by their own experiences, thoughts, or recent behaviors. To control for this, we provided attention checks and validated questions in the survey to make sure people paid attention or were obviously dishonest. For all cost or pricing estimations, we excluded the top 5 percent of all responses to control for outliers and people who gave obviously skewing figures (e.g., if someone said they thought a $100 stock would be worth $10 million in 10 years).

Fair use statement

Like a great realtor or mortgage lender reference, the information shown above is best shared. We encourage you to share this material or any of its graphics for any noncommercial purposes, but we ask that when you do, you cite the authors and link back to this page.