Property search process

Across generations, prospective buyers seemed eager to employ multiple methods in their search for a home. Yet, some techniques were particularly popular within a single age group: 57 percent of millennials, for example, used social media during their property hunt. Indeed, many experts say social networks are actually driving millennial interest in homeownership. With beautiful properties constantly appearing in their feeds, users aspire to buy themselves. In keeping with their digital proclivities, millennials were also most likely to utilize Craigslist and home search sites to check out appealing properties. Yet, the ease and wide selection of these platforms seem to do little to curb anxiety. Nine in 10 millennials were stressed by the home shopping process.

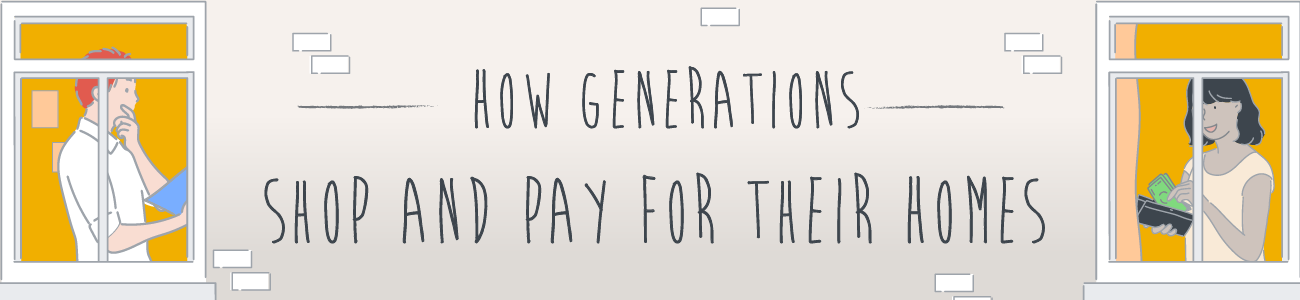

Across generations, prospective buyers seemed eager to employ multiple methods in their search for a home. Yet, some techniques were particularly popular within a single age group: 57 percent of millennials, for example, used social media during their property hunt. Indeed, many experts say social networks are actually driving millennial interest in homeownership. With beautiful properties constantly appearing in their feeds, users aspire to buy themselves. In keeping with their digital proclivities, millennials were also most likely to utilize Craigslist and home search sites to check out appealing properties. Yet, the ease and wide selection of these platforms seem to do little to curb anxiety. Nine in 10 millennials were stressed by the home shopping process.  Conversely, baby boomers were the most likely to seek out available homes in-person, with nearly 39 percent physically exploring their desired neighborhoods. Interestingly, though, millennials and baby boomers were roughly equally likely to turn to a real estate agency, with Gen Xers slightly less certain to take this route. If this approach seems surprisingly traditional for the younger set, agencies have made a concerted effort to modernize, using social media platforms. Additionally, many agencies buy leads from home search sites, so millennials beginning their hunt online may often encounter an agency anyway.

Conversely, baby boomers were the most likely to seek out available homes in-person, with nearly 39 percent physically exploring their desired neighborhoods. Interestingly, though, millennials and baby boomers were roughly equally likely to turn to a real estate agency, with Gen Xers slightly less certain to take this route. If this approach seems surprisingly traditional for the younger set, agencies have made a concerted effort to modernize, using social media platforms. Additionally, many agencies buy leads from home search sites, so millennials beginning their hunt online may often encounter an agency anyway.

Relying on an agent?

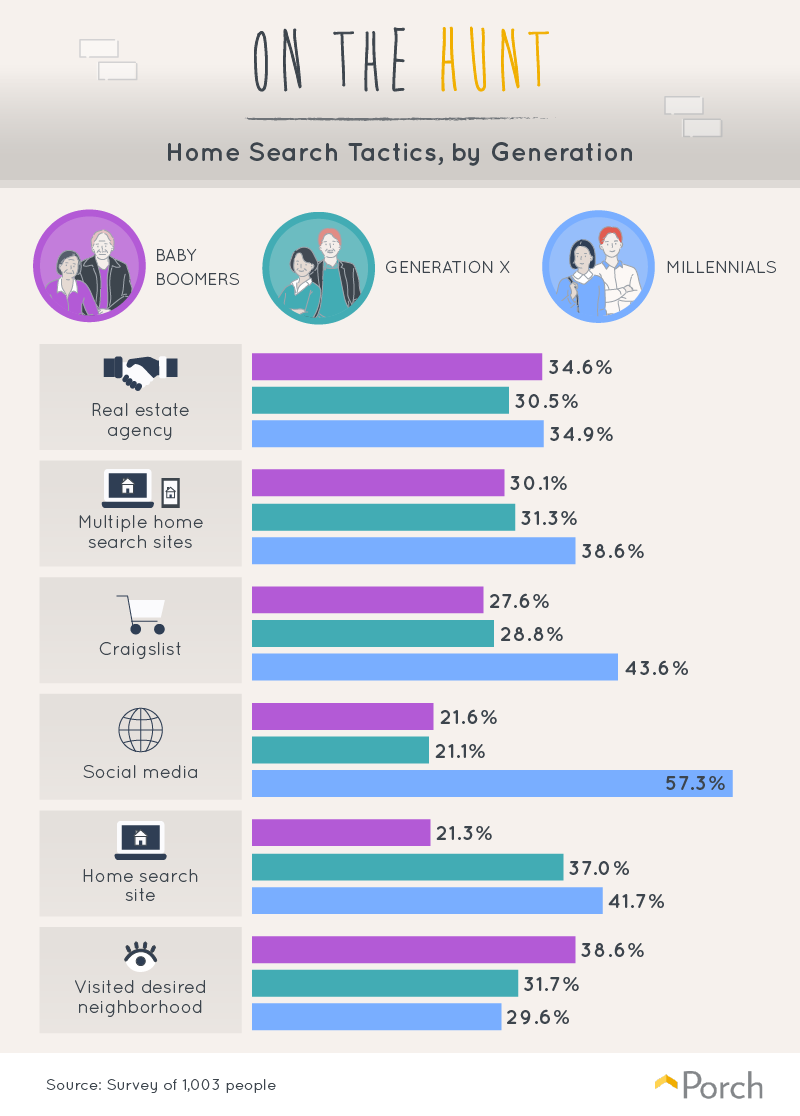

Individuals in each age group were roughly equally likely to seek the help of a real estate agent: Nearly two-thirds of each generation did so during their home search. But if these rates were consistent for each cohort, the professional expectations for real estate agents have certainly evolved over time. According to industry experts, real estate agents are increasingly positioning themselves as influencers as opposed to mere agents, curating personal brands on social media to attract younger clients. Among those who avoided using an agent, millennials seemed the most concerned with the associated fees, with 60 percent saying a real estate agent’s services would be too expensive. With so many parties involved in the typical real estate sale, the desire to reduce commission costs is certainly understandable. The expense was also a significant concern among Gen X buyers who didn’t use an agent, but almost 58 percent of this group simply believed they could do a better job themselves. This sentiment was even stronger among baby boomers: Of those who opted not to hire a real estate agent, three-quarters believed they’d have more success than a professional.

Individuals in each age group were roughly equally likely to seek the help of a real estate agent: Nearly two-thirds of each generation did so during their home search. But if these rates were consistent for each cohort, the professional expectations for real estate agents have certainly evolved over time. According to industry experts, real estate agents are increasingly positioning themselves as influencers as opposed to mere agents, curating personal brands on social media to attract younger clients. Among those who avoided using an agent, millennials seemed the most concerned with the associated fees, with 60 percent saying a real estate agent’s services would be too expensive. With so many parties involved in the typical real estate sale, the desire to reduce commission costs is certainly understandable. The expense was also a significant concern among Gen X buyers who didn’t use an agent, but almost 58 percent of this group simply believed they could do a better job themselves. This sentiment was even stronger among baby boomers: Of those who opted not to hire a real estate agent, three-quarters believed they’d have more success than a professional.

Must-haves: men and women

In some respects, male and female respondents expressed some of the same top property priorities: For both genders, the number of bedrooms and the surrounding neighborhood were primary concerns. But compelling differences in desired home characteristics emerged as well, such as men placing greater emphasis on proximity to work. This finding may reflect employment trends. While women have made great strides in terms of gender equality in the professional world, men are still significantly more likely to work outside the home—and to care about their commutes accordingly. For male and female respondents alike, bathroom count and square footage were among the top five priorities. Home size may be a particular concern for baby boomers and millennials alike, but for different reasons: Retirees seek to downsize in their later years, while younger buyers want room for growing families. Interestingly, buyers were somewhat less concerned with the condition of the foundation or the year the home was built—suggesting a willingness to take on a fixer-upper if the location and size are desirable.

In some respects, male and female respondents expressed some of the same top property priorities: For both genders, the number of bedrooms and the surrounding neighborhood were primary concerns. But compelling differences in desired home characteristics emerged as well, such as men placing greater emphasis on proximity to work. This finding may reflect employment trends. While women have made great strides in terms of gender equality in the professional world, men are still significantly more likely to work outside the home—and to care about their commutes accordingly. For male and female respondents alike, bathroom count and square footage were among the top five priorities. Home size may be a particular concern for baby boomers and millennials alike, but for different reasons: Retirees seek to downsize in their later years, while younger buyers want room for growing families. Interestingly, buyers were somewhat less concerned with the condition of the foundation or the year the home was built—suggesting a willingness to take on a fixer-upper if the location and size are desirable.

Down payment differences

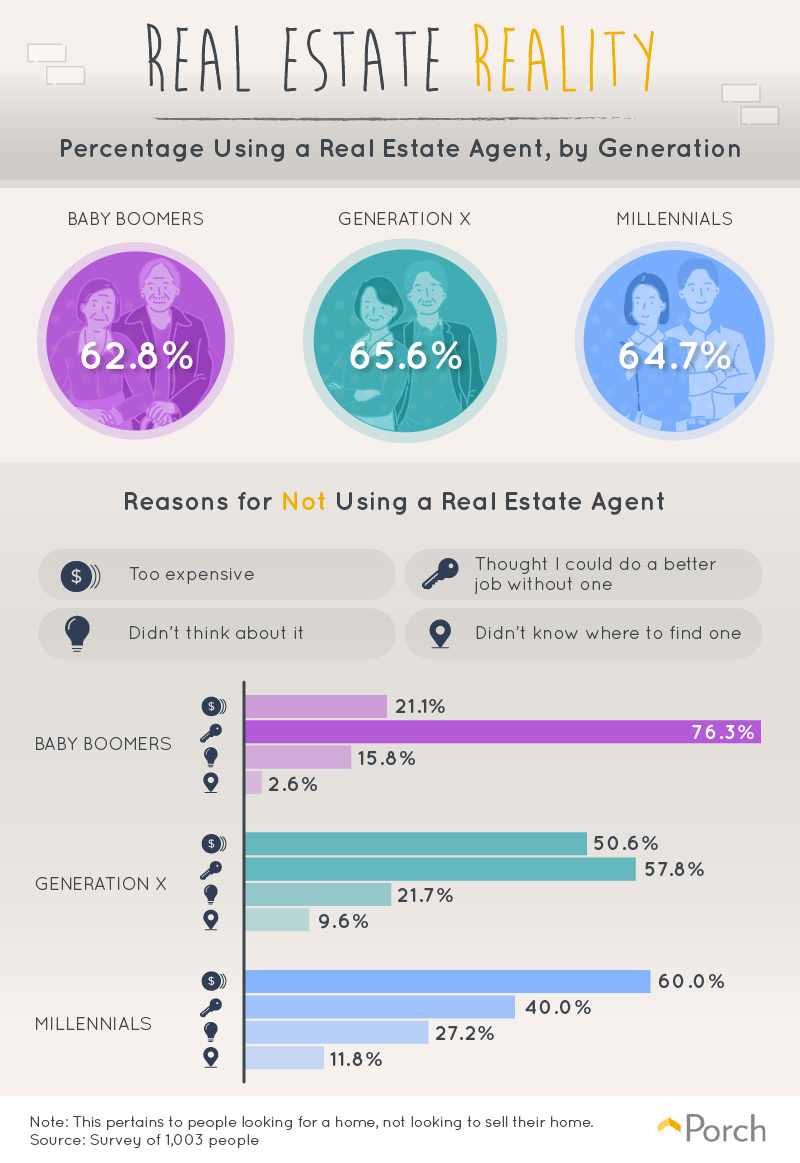

When it came to down payments, baby boomers handed over fewer dollars up front than either Gen Xers or millennials. But in interpreting these results, you’ll always want to keep inflation in mind. However, younger Americans may still have more difficulty buying into the housing market than their elders because home prices continue to rise faster than wages in many metropolitan areas. New construction is especially pricey: Since 2017, the median price for an entirely new home exceeded $300,000. Experts say millennials tend to shy away from fixer-uppers, so they pay top dollar for shiny houses unblemished by previous owners.

When it came to down payments, baby boomers handed over fewer dollars up front than either Gen Xers or millennials. But in interpreting these results, you’ll always want to keep inflation in mind. However, younger Americans may still have more difficulty buying into the housing market than their elders because home prices continue to rise faster than wages in many metropolitan areas. New construction is especially pricey: Since 2017, the median price for an entirely new home exceeded $300,000. Experts say millennials tend to shy away from fixer-uppers, so they pay top dollar for shiny houses unblemished by previous owners.

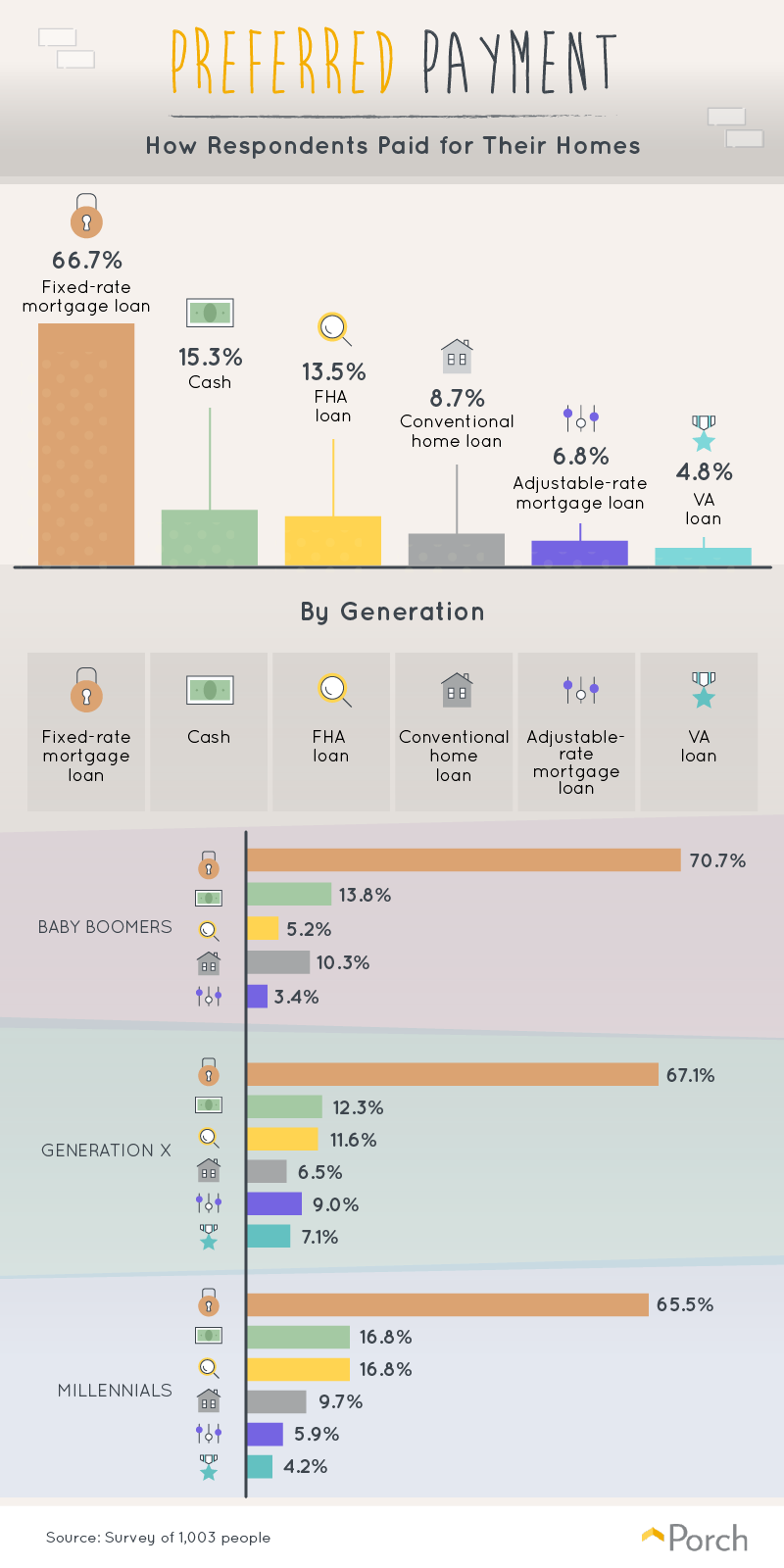

Mortgage methods

For homeowners in each age group, fixed-rate mortgages were the most common means of purchasing a home. Adjustable-rate mortgages, conversely, were relatively uncommon, either because fixed interest rates have remained low in recent years or consumers still regard adjustable-rate mortgages as risky in the wake of the recession. Twelve percent of Gen Xers and 17 percent of millennials relied on FHA loans, suggesting that buying a home is still a stretch for many young and middle-aged buyers. FHA loans require smaller down payments and can typically be acquired with relatively low credit scores—but buyers using this option must also pay to insure their mortgages. Interestingly, millennials were also the generation most likely to buy their homes with cash, with 17 percent doing so. Perhaps some millennials received money from family members to buy a home outright, or maybe some saved big by living with their parents until they could own a place of their own. Gen Xers, meanwhile, were the most likely to utilize government-backed VA loans. In these agreements, the government guarantees a portion of the loan made by a private lender, permitting the veteran to obtain much more favorable mortgage terms.

For homeowners in each age group, fixed-rate mortgages were the most common means of purchasing a home. Adjustable-rate mortgages, conversely, were relatively uncommon, either because fixed interest rates have remained low in recent years or consumers still regard adjustable-rate mortgages as risky in the wake of the recession. Twelve percent of Gen Xers and 17 percent of millennials relied on FHA loans, suggesting that buying a home is still a stretch for many young and middle-aged buyers. FHA loans require smaller down payments and can typically be acquired with relatively low credit scores—but buyers using this option must also pay to insure their mortgages. Interestingly, millennials were also the generation most likely to buy their homes with cash, with 17 percent doing so. Perhaps some millennials received money from family members to buy a home outright, or maybe some saved big by living with their parents until they could own a place of their own. Gen Xers, meanwhile, were the most likely to utilize government-backed VA loans. In these agreements, the government guarantees a portion of the loan made by a private lender, permitting the veteran to obtain much more favorable mortgage terms.

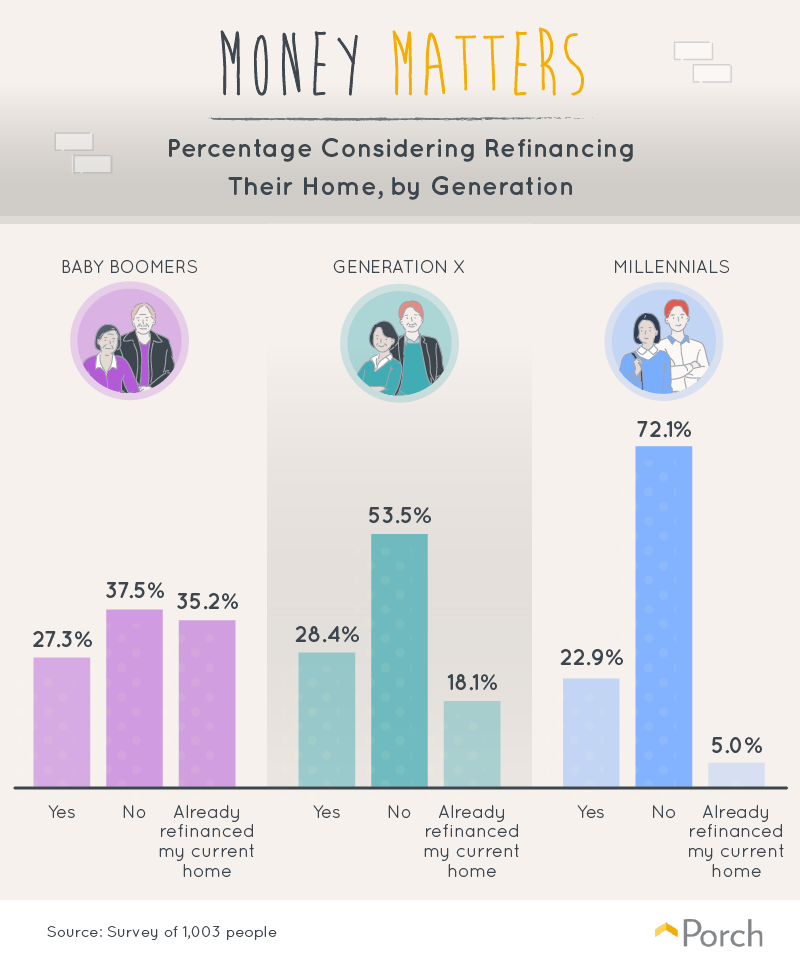

Feelings about refinancing

The appeal of refinancing one’s mortgage can vary dramatically over time: A temporary period of low interest rates can entice homeowners to seek better terms, even if they’re relatively content with their current deal. Generally speaking, however, mortgage rates have climbed since their post-recession nadir, meaning recent buyers have little room to negotiate for lower payments. Indeed, among millennials, 72 percent said they weren’t considering refinancing at all, and only 5 percent had refinanced already. With baby boomers, conversely, refinancing was relatively common: More than a third did so before, and another 27 percent considered it. Perhaps in some cases, baby boomers renegotiated their borrowing terms during the fallout of the Great Recession, obtaining better rates as a result. But financial need is also a common reason older Americans choose to refinance, turning to so-called “reverse mortgages” to fund their retirements. Eighteen percent of Gen Xers also refinanced their mortgages before. Many of this generation did so during the Great Recession, emerging relatively unscathed.

The appeal of refinancing one’s mortgage can vary dramatically over time: A temporary period of low interest rates can entice homeowners to seek better terms, even if they’re relatively content with their current deal. Generally speaking, however, mortgage rates have climbed since their post-recession nadir, meaning recent buyers have little room to negotiate for lower payments. Indeed, among millennials, 72 percent said they weren’t considering refinancing at all, and only 5 percent had refinanced already. With baby boomers, conversely, refinancing was relatively common: More than a third did so before, and another 27 percent considered it. Perhaps in some cases, baby boomers renegotiated their borrowing terms during the fallout of the Great Recession, obtaining better rates as a result. But financial need is also a common reason older Americans choose to refinance, turning to so-called “reverse mortgages” to fund their retirements. Eighteen percent of Gen Xers also refinanced their mortgages before. Many of this generation did so during the Great Recession, emerging relatively unscathed.

Reflections and regrets

Considering their homebuying process in retrospect, many respondents expressed regret that their search wasn’t more extensive—either in terms of scrutinizing the home they bought or exploring other properties. One male Gen Xer said he would have spent more time considering other houses, even visiting each more than once. A millennial male expressed similar feelings, wishing he’d held out longer. These experiences attest to the sense of urgency buyers often feel in competitive markets. Experts project scarcity in housing stock will improve in the coming years—although not by much in hot areas. In other cases, the extent or difficulty of necessary renovations proved surprisingly problematic. In one unfortunate situation, a baby boomer woman said she struggled to find a handyman capable of helping her around the house, causing her to regret her home purchase. In another instance, a millennial woman said the sellers artfully deceived her about the condition of a carpet. This experience reaffirms the importance of a thorough home inspection before buying, lest homeowners encounter irritating and expensive surprises later.

Considering their homebuying process in retrospect, many respondents expressed regret that their search wasn’t more extensive—either in terms of scrutinizing the home they bought or exploring other properties. One male Gen Xer said he would have spent more time considering other houses, even visiting each more than once. A millennial male expressed similar feelings, wishing he’d held out longer. These experiences attest to the sense of urgency buyers often feel in competitive markets. Experts project scarcity in housing stock will improve in the coming years—although not by much in hot areas. In other cases, the extent or difficulty of necessary renovations proved surprisingly problematic. In one unfortunate situation, a baby boomer woman said she struggled to find a handyman capable of helping her around the house, causing her to regret her home purchase. In another instance, a millennial woman said the sellers artfully deceived her about the condition of a carpet. This experience reaffirms the importance of a thorough home inspection before buying, lest homeowners encounter irritating and expensive surprises later.

Upgrades at any age

Our data present compelling contrasts in generational priorities, with millennials, Gen Xers, and baby boomers experiencing the homebuying process somewhat differently. The technologies used by potential buyers are reshaping the real estate industry, and each generation has encountered a distinct set of economic pressures. But, in many ways, the basic features of the homebuying process prevail. Mortgages remain an essential engine of homeownership, for example, and buyers often regret taking a plunge before adequately exploring their options. For homeowners in any generation, however, there’s good news regarding your investment. Even if your home seems glaringly imperfect, meaningful upgrades may be more affordable than you know. At Porch, we specialize in connecting homeowners with trusted, local home improvement professionals. Whether you want to up your resale value or simply improve your quality of life at home, we’ll find you the folks to get it done right. Explore our site today to see how we can help you make your home your own.

Methodology

To collect the data presented above, two separate surveys were run utilizing Amazon’s Mechanical Turk service. In the first survey, there were 1,003 respondents. Of those respondents, 121 were baby boomers, 282 were from Generation X, 589 were millennials, and 11 were from generations outside those. This survey was comprised of 570 women, 430 men, and three people who chose not to specify. For the second survey, there were 646 respondents in total. 351 identified as female, 293 identified as male, and two chose not to specify. There were 66 baby boomers, 195 Generation Xers, 372 millennials, and 13 respondents from a generation outside those. All the above data rely on self-reporting, which can be host to issues such as telescoping or exaggeration; so to verify that any answers received were as accurate as possible, attention checks were used. To qualify for either survey, respondents had to either have shopped for a house to rent or buy or currently resided in a house that they bought or rented for each respective survey. Amounts listed for down payments or amounts paid for respondents’ homes have not been adjusted for inflation.

Sources

- https://www.cnbc.com/2018/07/09/these-are-the-reasons-why-millions-of-millennials-cant-buy-houses.html

- https://www.nar.realtor/research-and-statistics/research-reports/home-buyer-and-seller-generational-trends

- https://www.usatoday.com/story/money/2018/05/07/millennials-buying-first-home-skip-starter-house-buy-dream/582309002/

- https://www.forbes.com/sites/donnafuscaldo/2018/09/26/home-buying-goes-high-tech-as-millennials-become-largest-real-estate-buyers/#438f24737774

- https://www.usatoday.com/story/money/2018/04/11/instagram-facebook-photos-spur-millennials-become-homeowners/504975002/

- https://www.forbes.com/sites/forbesrealestatecouncil/2018/02/06/what-is-the-role-of-a-real-estate-brokerage-in-2018/#627da77f2aa6

- https://www.forbes.com/sites/forbesrealestatecouncil/2018/07/13/what-agents-need-to-know-about-leads-from-online-home-search-engines/#58a7ce745548

- https://www.forbes.com/sites/forbesrealestatecouncil/2018/12/10/three-ways-to-position-yourself-as-a-real-estate-influencer/#2be3a2c25784

- https://www.forbes.com/sites/forbesrealestatecouncil/2018/06/06/first-timer-faq-how-do-real-estate-commissions-work/#2bdfd8243894

- https://yaleglobal.yale.edu/content/despite-growing-gender-equality-more-women-stay-home-men

- https://www.marketwatch.com/story/this-is-what-millennials-and-boomers-are-looking-for-in-a-home-2018-12-12

- https://data.bls.gov/cgi-bin/cpicalc.pl?cost1=15%2C852.00&year1=199001&year2=201812

- https://www.housingwire.com/articles/47878-home-prices-are-rising-faster-than-wages-in-80-of-us-markets

- https://www.census.gov/construction/nrs/pdf/uspricemon.pdf

- https://www.newsday.com/classifieds/real-estate/home-sales-millennials-1.16304337

- https://www.marketwatch.com/story/a-farewell-to-arms-americans-still-shun-adjustable-rate-mortgages-10-years-after-the-crisis-2018-07-09

- https://loans.usnews.com/fha-vs-conventional-loans-in-plain-english

- https://www.businessinsider.com/millennial-homebuying-parents-help-realtor-advice-2018-12

- https://www.benefits.va.gov/homeloans/resources_veteran.asp#Benefit

- https://www.reuters.com/article/us-usa-economy-mba/many-more-americans-seek-home-loans-as-rates-drop-mba-idUSKCN1P31HG

- https://www.marketwatch.com/story/cash-out-mortgage-refis-are-back-will-homes-become-atms-again-2018-03-30

- https://www.housingwire.com/blogs/1-rewired/post/46700-lack-of-retirement-savings-haunts-baby-boomers

- http://www.pewresearch.org/fact-tank/2018/07/23/gen-x-rebounds-as-the-only-generation-to-recover-the-wealth-lost-after-the-housing-crash/

- https://www.forbes.com/sites/alyyale/2018/12/06/2019-real-estate-forecast-what-home-buyers-sellers-and-investors-can-expect/#1ab974ae70d9

- https://realestate.usnews.com/real-estate/articles/a-checklist-for-home-inspections

Fair use statement

Unlike Americans in every generation, this project has no intention of settling down in a single home. In fact, we hope you’ll help it travel across the web by sharing it with your friends and family. If you do decide to share our content, just link back to this page so that other readers can see our full findings. Please use our work for noncommercial purposes only.