By many measures, it’s a great time to be in the market for a mortgage. In recent months, home mortgage interest rates have plunged to historic depths, and experts expect them to stay attractively low for the foreseeable future.

But while appealing interest rates have sparked periodic surges in home-buying activity, not everyone can take advantage of favorable borrowing conditions. Researchers note that the size of the average mortgage has significantly increased as of late, surpassing the nation’s median home value. This trend suggests that wealthy folks are capitalizing on great interest rates to upgrade their homes, whereas Americans of more modest means are struggling to find affordable options.

To study these developments in greater detail, we analyzed the Home Mortgage Disclosure Act (HMDA) database, the federal government’s extensive record of housing loans across America. Where are new mortgages increasing, and which kinds of properties are driving this borrowing activity? What other kinds of home loans are common, and which states enjoy the best rates? Keep reading to find out.

New mortgages: size and frequency by state

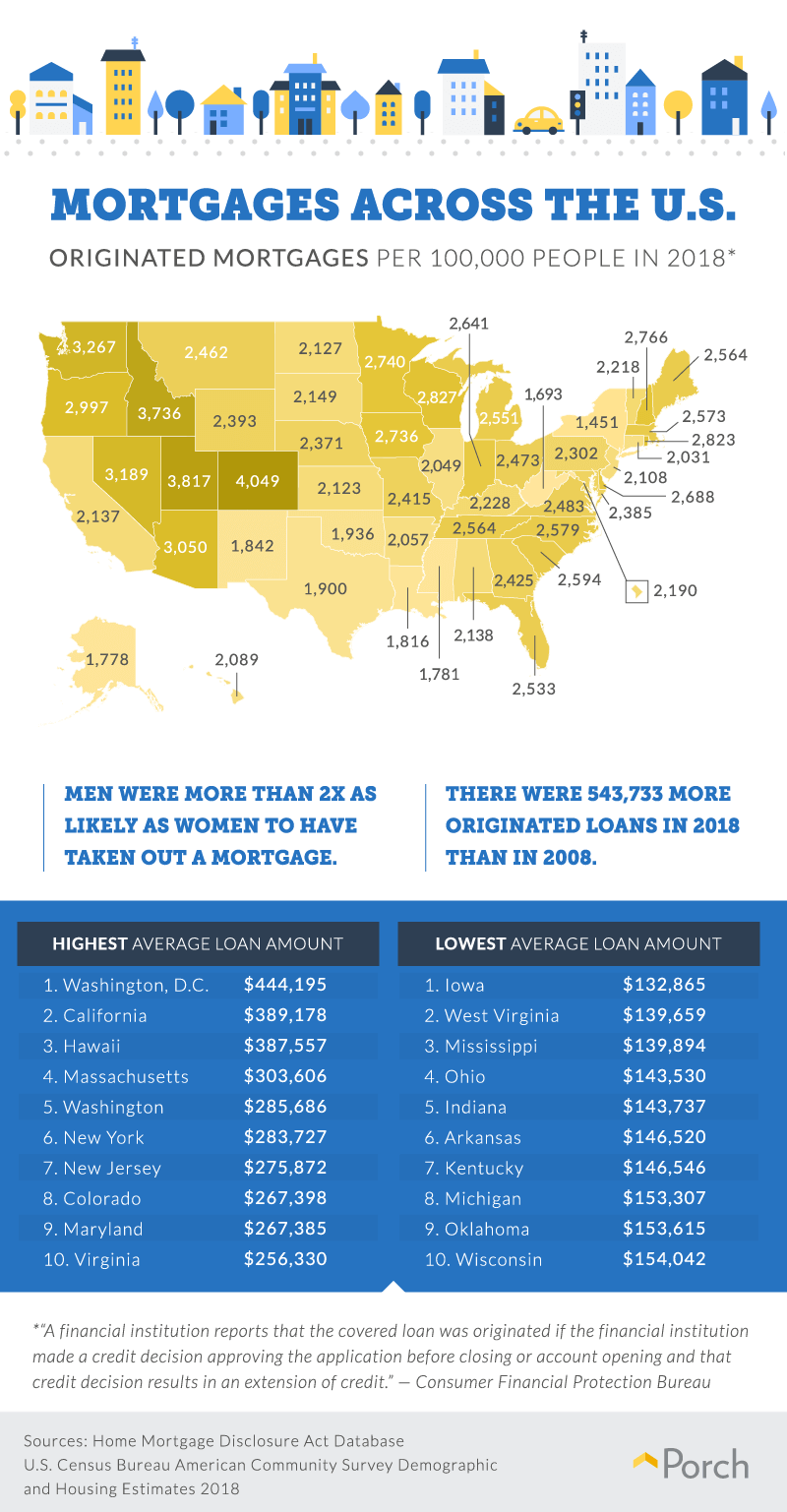

Relative to the depths of the Great Recession, recent mortgage figures seem especially impressive. In 2018, Americans took out 543,733 more home loans than in 2008, when the subprime mortgage crisis thrust the housing market into turmoil.

However, this rebound in borrowing activity has been uneven—in both demographic and geographic terms. Interestingly, our findings indicate that men were more than two times as likely as women to have taken out a mortgage, despite research suggesting that single women are more likely than single men to buy their own homes. The age of single female buyers might explain these trends: Many are older women downsizing after the death of their partners, and therefore wouldn’t need a new mortgage to afford their new homes.

Additionally, the number of mortgages originated per capita varied significantly from state to state. Most of the states with the highest mortgage origination rates were clustered in the country’s Western region, including Colorado, Utah, and Idaho. Likely due in part to their natural beauty, each of these states has experienced a sharp influx of new residents in recent years.

In many of the states with the fewest mortgages per capita, such as Mississippi and West Virginia, the average loan size was relatively small, as well. This connection makes sense in many respects: In places where people are buying fewer homes, real estate prices naturally fall. Elsewhere, however, a very different phenomenon occurred: In expensive areas such as California, Hawaii, and Massachusetts, fewer residents can afford the big mortgages necessary to buy a typical home.

Mortgage motives

The vast majority of loans included in our data were made in connection with a primary residence. In a nation where homeownership rates are falling, it’s difficult enough to afford just one property. Roughly 7 percent of loans were made for investment properties, while 3 percent went toward secondary residences. Those who did take out loans related to investment properties or second homes tended to be older: Perhaps people later in life are more likely to have amassed the necessary wealth.

That being said, certain states were hotbeds for real estate investment: Oklahoma saw 13.7 percent of mortgages originated in the state connected with investment properties, while Arkansas and Hawaii had 13.5 percent and 12.2 percent, respectively. These statistics reflect the growing populations of these states, but also real opportunities in certain areas. With affordable real estate and market stability in Oklahoma, for example, being a landlord has the potential to be a lucrative business.

While most mortgages went toward a home purchase, about 30 percent involved some form of refinancing in 2018. This trend has intensified in subsequent months, as homeowners seize on low interest rates to pull out cash from their homes or negotiate better terms. Additionally, about 7 percent of loans were taken out to fund home improvement projects. In response to shortages of housing stock in many markets, it seems many buyers are willing to invest in fixer-uppers instead of paying turnkey prices.

Interest inequities?

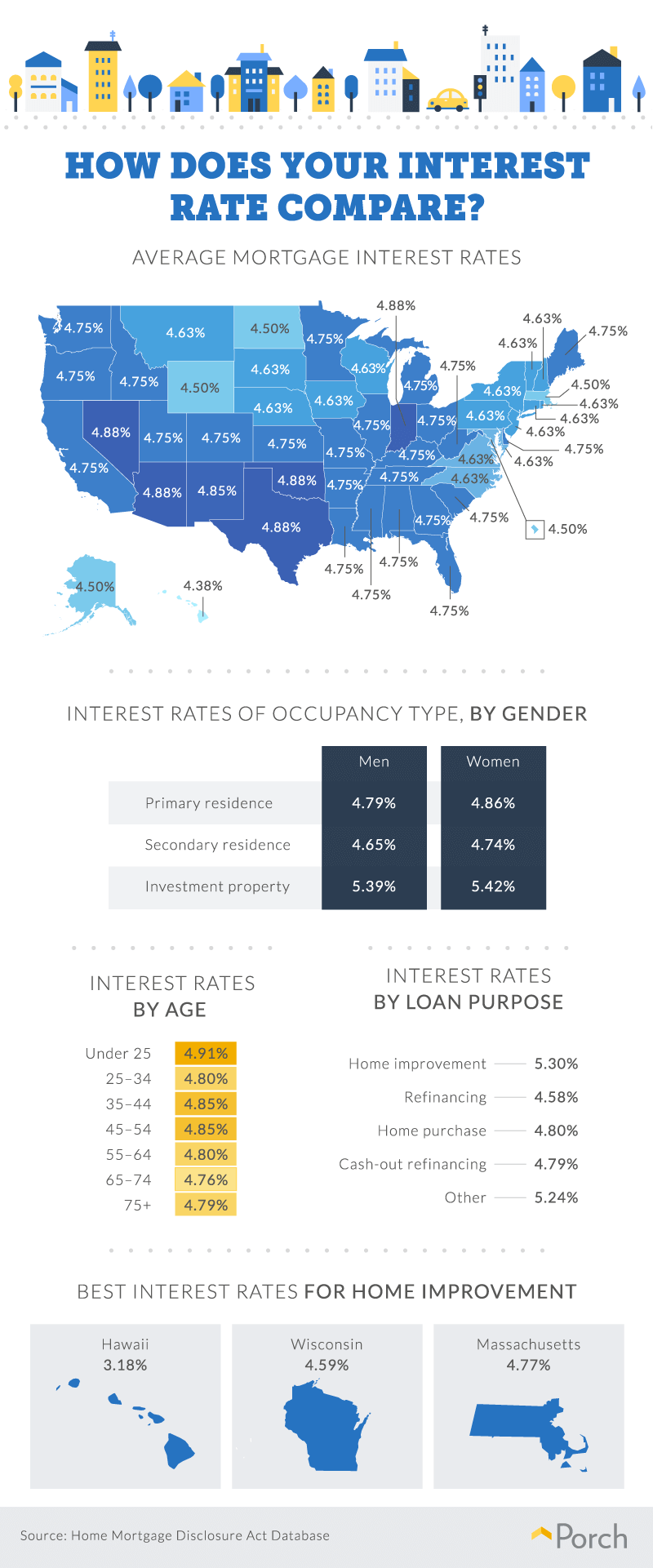

Location determines more than home prices: You’ll also pay more to borrow in certain states. Across much of the Southwest, for example, interest rates neared 5 percent, on average, in 2018. Conversely, in states such as Wyoming and North Dakota, the average interest rate was just 4.5 percent. Perhaps in these less populated places, lenders must compete harder for a smaller pool of prospective buyers.

Age also seemed to matter to some extent, with older borrowers obtaining the best rates. Though the average rates differed only slightly between age groups, these tiny distinctions can translate to hundreds of dollars in additional fees over the life of a home loan.

Unfortunately, our results also suggest that female borrowers are generally offered worse interest rates than men, whether buying a primary residence, second home, or investment property. These results resonate with existing research indicating that institutions sometimes utilize algorithms that disadvantage certain demographic groups.

Generally, home improvement loans tended to have higher interest rates than mortgages for refinancing or new home purchases. Because these loans are usually smaller than purchase loans, banks may demand more interest to make the deal worth their while. However, this trend wasn’t true everywhere: In Hawaii, home improvement loan interest rates were more than a point lower, on average, than in any other state. Perhaps in a state with relatively few home-related loans of any kind, lenders feel compelled to compete for customers.

Investment and improvement: borrowing for a better future

Our results illustrate a robust home loan market: Since the Great Recession, new mortgage numbers have rebounded, with particularly strong borrowing activity in several Western states. And though the majority of these mortgages fund home purchases, a significant percentage are used to refinance existing housing debt, a move that could yield long-term savings for many families given current low interest rates.

Sure, this mortgage activity reflects a certain amount of fiscal optimism, whether borrowers are buying a first home or purchasing an investment property. But any kind of home loan entails some degree of risk, even in the most favorable economic conditions. Accordingly, you shouldn’t accept overpaying to protect your most important investment—or hire unqualified professionals who can do more harm than good. Always make sure your realtor has a real estate license. Even in good times, it pays to be smart about quality and costs.

Porch lets you do just that, empowering you to hire trusted professionals at reasonable rates. Our platform allows you to compare quotes and reviews for a wide array of local service providers so that you can hire with confidence. Whether you’re renovating or simply keeping your home in great shape, take the savvy approach to protect your home’s value.

Methodology

The data above were compiled using the Home Mortgage Disclosure Act database from the Consumer Financial Protection Bureau from 2018. Only data from originated loans were included. We only analyzed data from the 50 states, excluding U.S. territories such as Guam, Puerto Rico, the U.S. Virgin Islands, and other territories within the data set. Loans secured by dwellings, but not for the purposes of a home purchase, home improvement, or refinance, are listed as “other.” The data were calculated to exclude outliers. We did this by finding initial averages and standard deviations for the data. Then, the standard deviation was multiplied by two and added to the initial average. Any data point above the calculated number was then excluded from the data. For more information regarding the data, please visit the Consumer Financial Protection Bureau.

Fair Use Statement

If you know people who are considering a home loan currently, they might find our results compelling. We encourage you to share this project with them or any other readers who might enjoy our work. Please share our project’s information and images only for noncommercial purposes. If you do, we kindly request that you link back to this page to properly attribute our team.