Inspection expenses

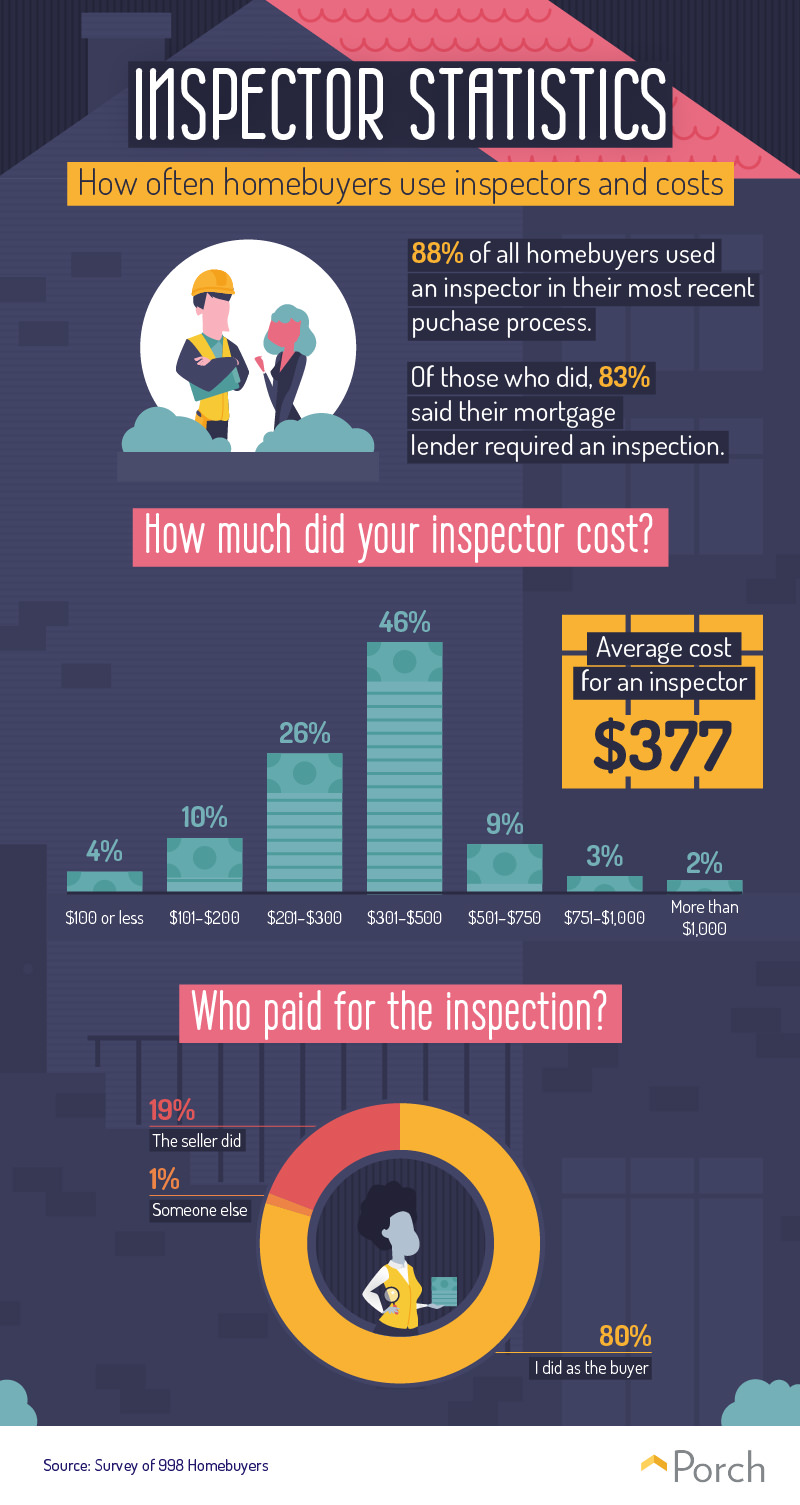

Our findings indicate that inspections are still a standard element of the homebuying experience: Nearly 9 in 10 homebuyers used an inspector when purchasing their properties. This result reflects typical mortgage requirements, with 83 percent who used an inspector reporting that their lender insisted on an assessment. For those unfamiliar with real estate lingo, it’s worth noting that appraisals and inspections differ in their purposes and procedures. While appraisers confirm the value of the home for the mortgage lender’s benefit, inspectors scrutinize the property’s condition, identifying current or impending issues. Among our respondents, the majority reported paying $500 or less to have their homes inspected. The average inspection cost was $377—no small sum, but far less than other fees associated with purchasing a home, such as realtor commissions. In 80 percent of cases, the buyers paid for the inspection. This arrangement could instill greater confidence in the accuracy of the results: Buyers might be skeptical of an inspector paid for by a seller. Yet, in nearly a fifth of cases, the seller did foot the bill for the inspection. This benefit is sometimes offered as a part of a “closing cost assistance” package, designed to help buyers short on cash seal the deal.

Our findings indicate that inspections are still a standard element of the homebuying experience: Nearly 9 in 10 homebuyers used an inspector when purchasing their properties. This result reflects typical mortgage requirements, with 83 percent who used an inspector reporting that their lender insisted on an assessment. For those unfamiliar with real estate lingo, it’s worth noting that appraisals and inspections differ in their purposes and procedures. While appraisers confirm the value of the home for the mortgage lender’s benefit, inspectors scrutinize the property’s condition, identifying current or impending issues. Among our respondents, the majority reported paying $500 or less to have their homes inspected. The average inspection cost was $377—no small sum, but far less than other fees associated with purchasing a home, such as realtor commissions. In 80 percent of cases, the buyers paid for the inspection. This arrangement could instill greater confidence in the accuracy of the results: Buyers might be skeptical of an inspector paid for by a seller. Yet, in nearly a fifth of cases, the seller did foot the bill for the inspection. This benefit is sometimes offered as a part of a “closing cost assistance” package, designed to help buyers short on cash seal the deal.

How inspectors get hired

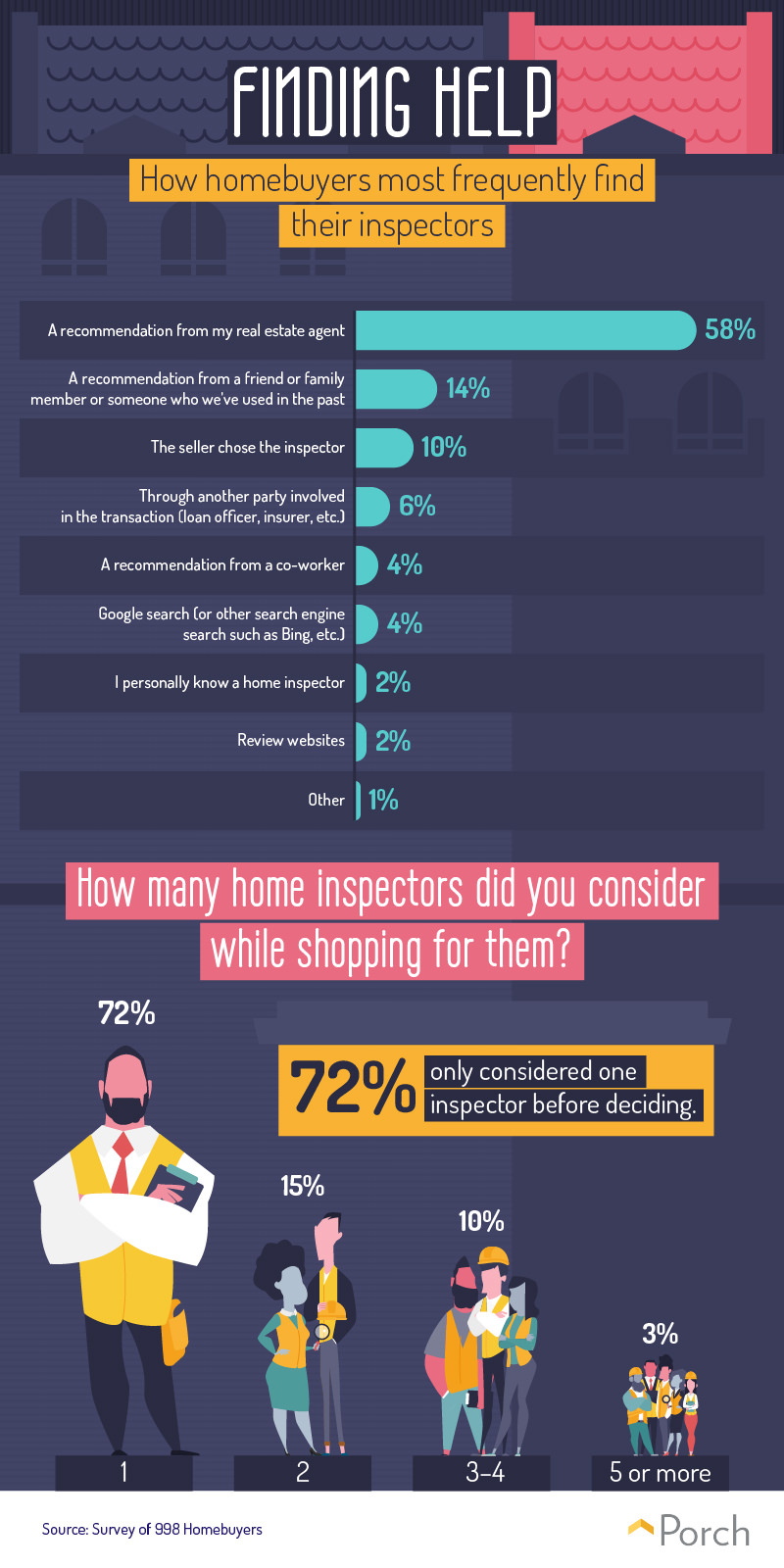

In most cases, homebuyers found their inspector through their real estate agent. In many ways, this pattern makes sense: Real estate agents have all manner of experiences with inspectors and can steer you toward a good one accordingly. Of course, you might worry that your agent and inspector could be in cahoots, glazing over serious issues to ensure a sale goes through. But that kind of collusion would be extremely shortsighted: Agents and inspectors depend on positive recommendations from past clients and betraying a buyer would be grounds for legal action. Another 14 percent of people chose their inspector based on a friend’s or family member’s recommendation, while 10 percent said the seller picked who would perform the inspection. In any case, few buyers considered multiple professionals: 72 percent said they only considered one inspector before moving forward. This hastiness probably reflects condensed contingency time frames. Buyers often have just a couple of weeks or less to perform an inspection, so they can’t spend much time comparing alternatives. Still, experience matters. Exploring your options could give you greater confidence in the inspector you eventually pick.

In most cases, homebuyers found their inspector through their real estate agent. In many ways, this pattern makes sense: Real estate agents have all manner of experiences with inspectors and can steer you toward a good one accordingly. Of course, you might worry that your agent and inspector could be in cahoots, glazing over serious issues to ensure a sale goes through. But that kind of collusion would be extremely shortsighted: Agents and inspectors depend on positive recommendations from past clients and betraying a buyer would be grounds for legal action. Another 14 percent of people chose their inspector based on a friend’s or family member’s recommendation, while 10 percent said the seller picked who would perform the inspection. In any case, few buyers considered multiple professionals: 72 percent said they only considered one inspector before moving forward. This hastiness probably reflects condensed contingency time frames. Buyers often have just a couple of weeks or less to perform an inspection, so they can’t spend much time comparing alternatives. Still, experience matters. Exploring your options could give you greater confidence in the inspector you eventually pick.

What inspectors uncover

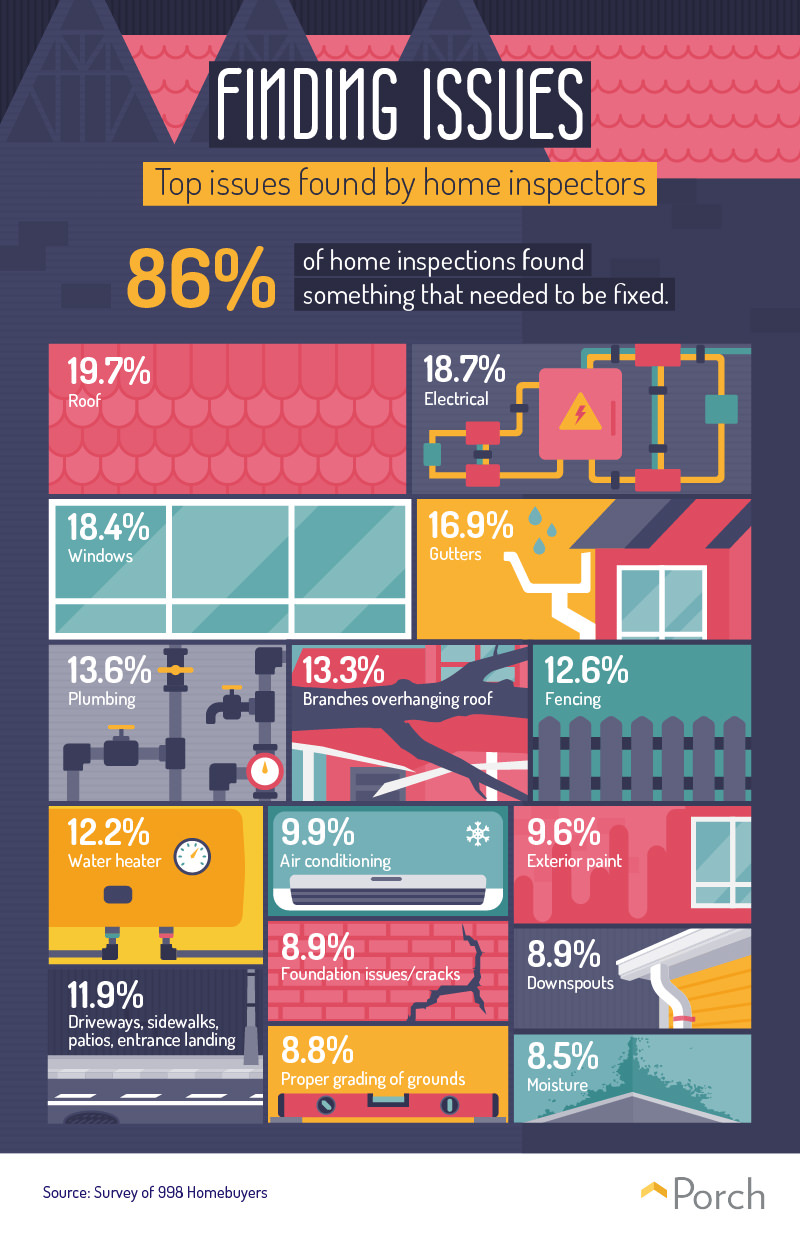

Few home inspections come up completely clean. Of the respondents who had an inspection performed, 86 percent said their inspector identified at least one problem. Moreover, some of the most common issues threatened the essential components of a home. In a fifth of cases where a problem was uncovered, the home’s roof was the culprit: From cosmetic issues to more serious cracks and leaks, a home’s top layer can be prone to decay over time. Electrical problems were nearly as common—but could have considerably higher stakes. Left undiagnosed, wiring issues can expose residents to electrocution or house fires. Problems with windows were also quite prevalent, showing up on over 18 percent of reports in which issues were detected. Because properly sealed windows can substantially reduce one’s energy bills, this repair could result in significant long-term savings. Likewise, homebuyers could reduce their water bill by fixing plumbing problems, which were frequently found as well. Additionally, more modest exterior fixes often turned up inspections: Gutter issues, branches overhanging the roof, and fencing problems appeared on more than 10 percent of reports.

Few home inspections come up completely clean. Of the respondents who had an inspection performed, 86 percent said their inspector identified at least one problem. Moreover, some of the most common issues threatened the essential components of a home. In a fifth of cases where a problem was uncovered, the home’s roof was the culprit: From cosmetic issues to more serious cracks and leaks, a home’s top layer can be prone to decay over time. Electrical problems were nearly as common—but could have considerably higher stakes. Left undiagnosed, wiring issues can expose residents to electrocution or house fires. Problems with windows were also quite prevalent, showing up on over 18 percent of reports in which issues were detected. Because properly sealed windows can substantially reduce one’s energy bills, this repair could result in significant long-term savings. Likewise, homebuyers could reduce their water bill by fixing plumbing problems, which were frequently found as well. Additionally, more modest exterior fixes often turned up inspections: Gutter issues, branches overhanging the roof, and fencing problems appeared on more than 10 percent of reports.

Problems and prices

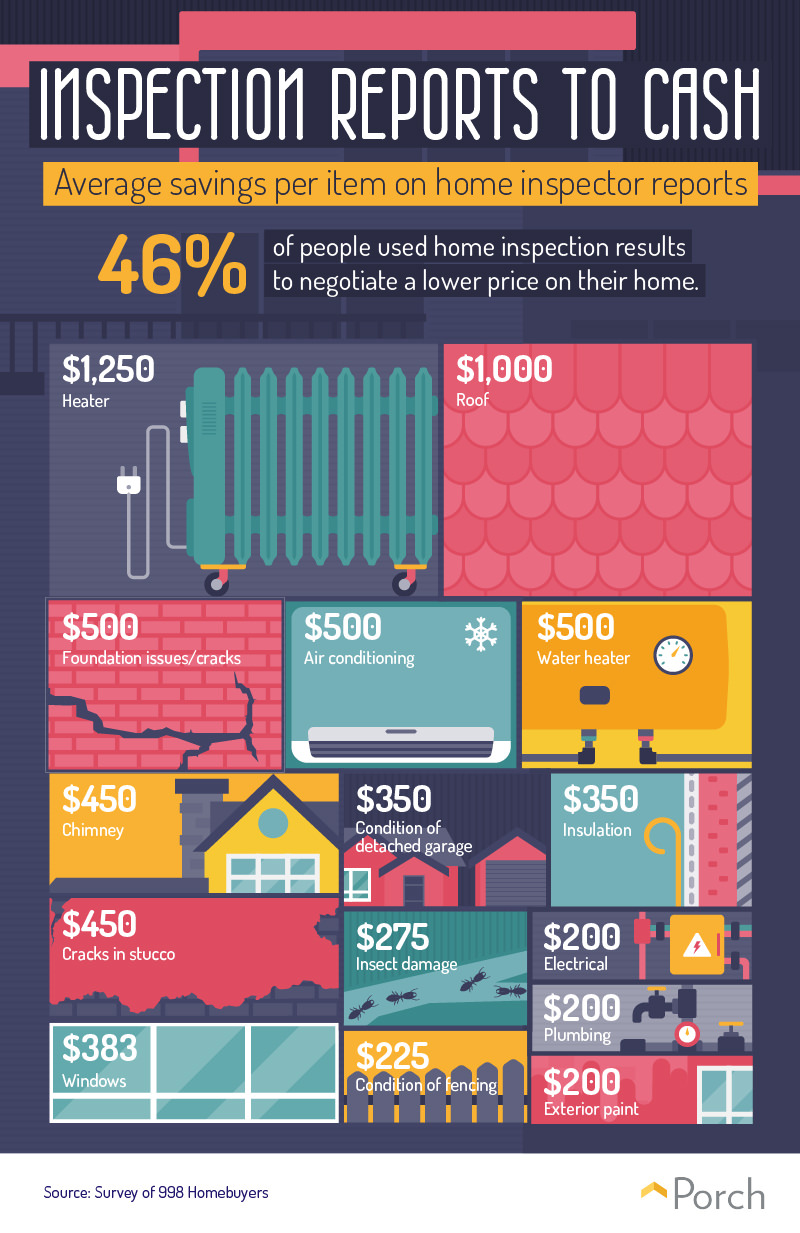

Once problems emerge through an inspection, what can be done about them? In nearly half of cases in which home inspections turned up problems, buyers and their agents were able to bargain down the final sales price. As one might expect, the anticipated cost of the repair determined how much buyers could typically knock off the purchase price. Homebuyers who discovered problems with the heater, for example, negotiated their purchase price down by $1,250 on average. That’s roughly how much installing a new heater would cost, according to our Porch project cost estimate. Frequently, however, price reductions seemed to reflect the cost of repairing a failing feature of the home, rather than replacing it entirely. For example, homebuyers dealing with air conditioning problems negotiated a $500 price reduction on average; installing a new system would cost several times that amount. Ultimately, these results reflect a compromise between the parties involved. While sellers should be prepared to make concessions on some repairs, buyers shouldn’t expect major upgrades either.

Once problems emerge through an inspection, what can be done about them? In nearly half of cases in which home inspections turned up problems, buyers and their agents were able to bargain down the final sales price. As one might expect, the anticipated cost of the repair determined how much buyers could typically knock off the purchase price. Homebuyers who discovered problems with the heater, for example, negotiated their purchase price down by $1,250 on average. That’s roughly how much installing a new heater would cost, according to our Porch project cost estimate. Frequently, however, price reductions seemed to reflect the cost of repairing a failing feature of the home, rather than replacing it entirely. For example, homebuyers dealing with air conditioning problems negotiated a $500 price reduction on average; installing a new system would cost several times that amount. Ultimately, these results reflect a compromise between the parties involved. While sellers should be prepared to make concessions on some repairs, buyers shouldn’t expect major upgrades either.

Inspection investment

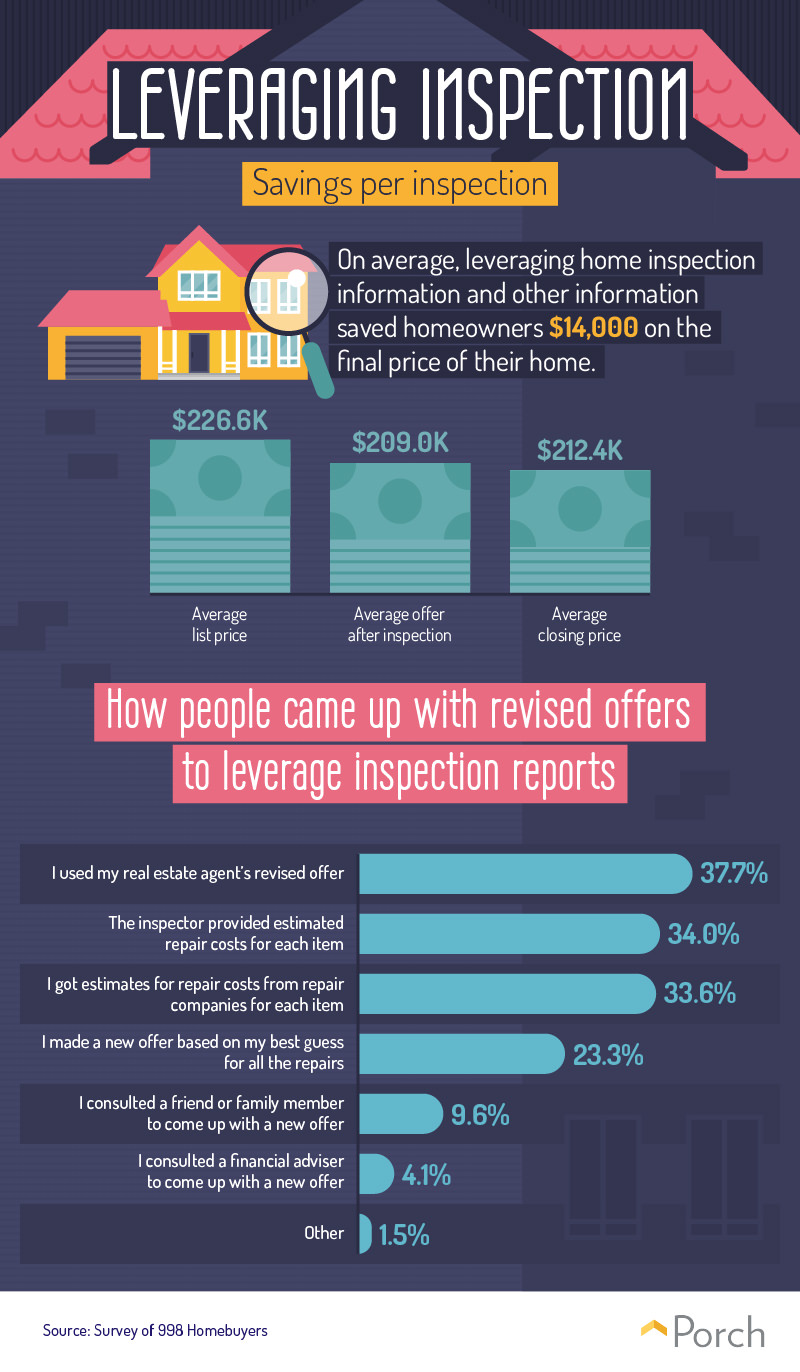

The financial impact of an inspector’s report can be impressive. On average, respondents reported saving $14,000 on the final price of their home by negotiating based on their inspection. That doesn’t mean they got everything they wanted: Like all things real estate, repair discussions involved a delicate give and take. Following the inspection, buyers offered an average of $209,000 for the home they wanted to buy. Yet, their average closing price was roughly $3,400 higher, suggesting that sellers pushed back on some of their demands. Indeed, it can be difficult to decide how much to revise one’s offer following an inspection. Compile a laundry list of major demands, and a seller could decide to scrap the deal altogether. In 38 percent of cases, buyers took their agent’s advice about revising their offer after an inspection. Another third of buyers said their inspector estimated the costs of each necessary repair, while a similar percentage got separate estimates for each fix. Thankfully, only 23 percent reported they relied on guesswork to revise their offer.

The financial impact of an inspector’s report can be impressive. On average, respondents reported saving $14,000 on the final price of their home by negotiating based on their inspection. That doesn’t mean they got everything they wanted: Like all things real estate, repair discussions involved a delicate give and take. Following the inspection, buyers offered an average of $209,000 for the home they wanted to buy. Yet, their average closing price was roughly $3,400 higher, suggesting that sellers pushed back on some of their demands. Indeed, it can be difficult to decide how much to revise one’s offer following an inspection. Compile a laundry list of major demands, and a seller could decide to scrap the deal altogether. In 38 percent of cases, buyers took their agent’s advice about revising their offer after an inspection. Another third of buyers said their inspector estimated the costs of each necessary repair, while a similar percentage got separate estimates for each fix. Thankfully, only 23 percent reported they relied on guesswork to revise their offer.

Lessons for homebuyers

Certainly, if we learned anything in our survey, it’s that homebuyers who are knowledgeable about the process can use inspectors to their advantage. To conclude our survey, we asked for homeowners’ advice on what they wish they had known about inspectors. Here are our favorite responses.

Professional precautions: Before and after buying a home

As the results of this project make abundantly clear, home inspections can be extremely prudent investments, saving homebuyers from unforeseen fiscal challenges. Citing necessary repairs, agents can knock thousands off the price their clients might otherwise have paid. Perhaps the greatest benefit of home inspections, however, may be the peace of mind. Buying a home involves enough stress and uncertainty. Spare yourself any unnecessary anxiety: Trust an experienced professional to diagnose the issues you need to know about. Maybe you’re looking for a top home inspector right now. Or perhaps you’ve already had an inspection and need experts to make the suggested improvements. Whether you’ve lived in your home for years or find yourself looking for a new one, Porch has you covered. We match you with top-rated professionals in your local area, so you never need to wonder if you’ve hired the right person. Just tell us a bit about your project, and we’ll walk you through the rest. To see just how simple it is, try it yourself for free today. Methodology To compile the data shown above, we surveyed 998 homeowners on their experiences with homebuying and home inspections. Of those we surveyed, 818 owned single-family houses, 99 owned a condo or town house, and 81 owned an apartment. Respondents came from 48 of the 50 states and ranged in age between 18 and 75 with a median age of 37. Because people could have purchased and owned multiple homes, we asked people to only think of their most recent homebuying experience when answering questions. Because this was a survey and we asked people to recall their most recent experience, it is susceptible to the same biases of most other surveys, specifically regarding biases such as hindsight and telescoping. Sources

- https://www.investopedia.com/articles/mortgages-real-estate/08/home-inspection.asp

- https://www.consumerreports.org/real-estate/how-to-choose-a-home-inspector/

- https://www.investopedia.com/articles/pf/12/home-appraisals.asp

- https://www.forbes.com/sites/forbesrealestatecouncil/2018/02/06/what-is-the-role-of-a-real-estate-brokerage-in-2018/#6309b40a2aa6

- https://homeguides.sfgate.com/responsible-house-inspection-appraisal-seller-buyer-72433.html

- https://www.thebalance.com/should-you-use-an-agent-s-recommended-home-inspector-1798674

- https://www.thespruce.com/most-common-problem-areas-of-a-roof-system-2902128

- https://www.energy.gov/energysaver/design/windows-doors-and-skylights/update-or-replace-windows

- https://www.thespruce.com/save-money-on-your-water-bill-1388747

- https://www.realtor.com/advice/buy/home-inspection-mistakes-buyers-should-avoid/

Fair use statement We hope you enjoyed reading this project and encourage you to share it with others. But just like careful homebuyers who ask for inspections, we do have to take a couple of precautions. First, we ask that you only use this work for noncommercial purposes. Second, please include a link back to this page to attribute our team appropriately. Thanks in advance for your help—and for sharing this project with a wider audience.