Some things stay the same

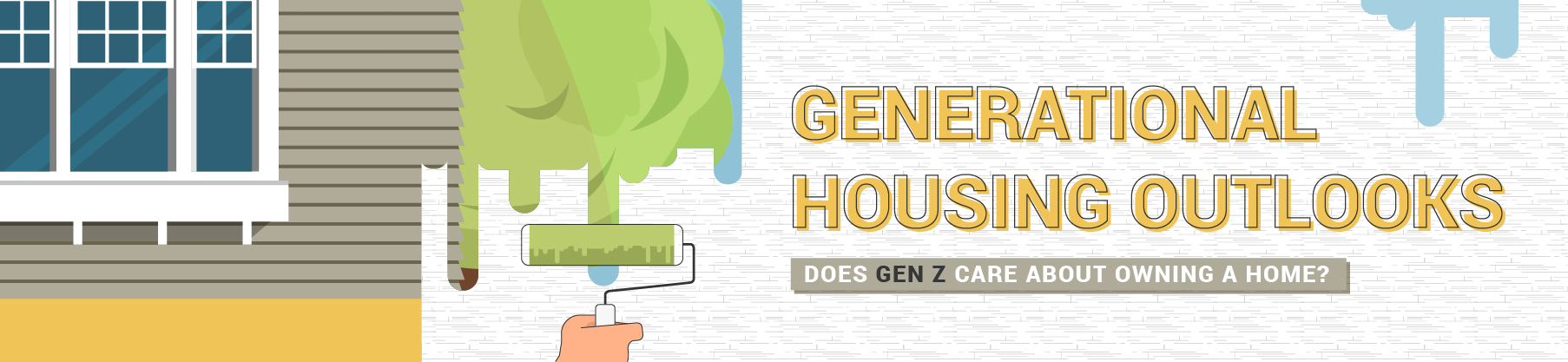

It’s evident that the younger generation isn’t a fan of hefty spending, so it might come as a surprise that Gen Zers, like those before them, remain interested in homeownership. Although 87.7 percent of Gen Zers believed they would own a home, we found that 1 in 8 Gen Zers who currently rented thought they would never own a home. Of those who held the opinion that homeownership would never happen for them, 73.4 percent said owning a home was not affordable. Experts have pointed out that one of the reasons that buying a home is not affordable for young families, like millennials and Gen Zers, is because there aren’t enough smaller houses available for purchase. In fact, data from the National Association of Home Builders (NAHB) shows that “more developers across the country are beginning to cater to [middle-class] buyers” and are now focused on building “entry-level” housing. Our findings support that realization: 15.8 percent of those who believed they would never own said it was because a home offers “too much space.”

It’s evident that the younger generation isn’t a fan of hefty spending, so it might come as a surprise that Gen Zers, like those before them, remain interested in homeownership. Although 87.7 percent of Gen Zers believed they would own a home, we found that 1 in 8 Gen Zers who currently rented thought they would never own a home. Of those who held the opinion that homeownership would never happen for them, 73.4 percent said owning a home was not affordable. Experts have pointed out that one of the reasons that buying a home is not affordable for young families, like millennials and Gen Zers, is because there aren’t enough smaller houses available for purchase. In fact, data from the National Association of Home Builders (NAHB) shows that “more developers across the country are beginning to cater to [middle-class] buyers” and are now focused on building “entry-level” housing. Our findings support that realization: 15.8 percent of those who believed they would never own said it was because a home offers “too much space.”

We want it, but not right now

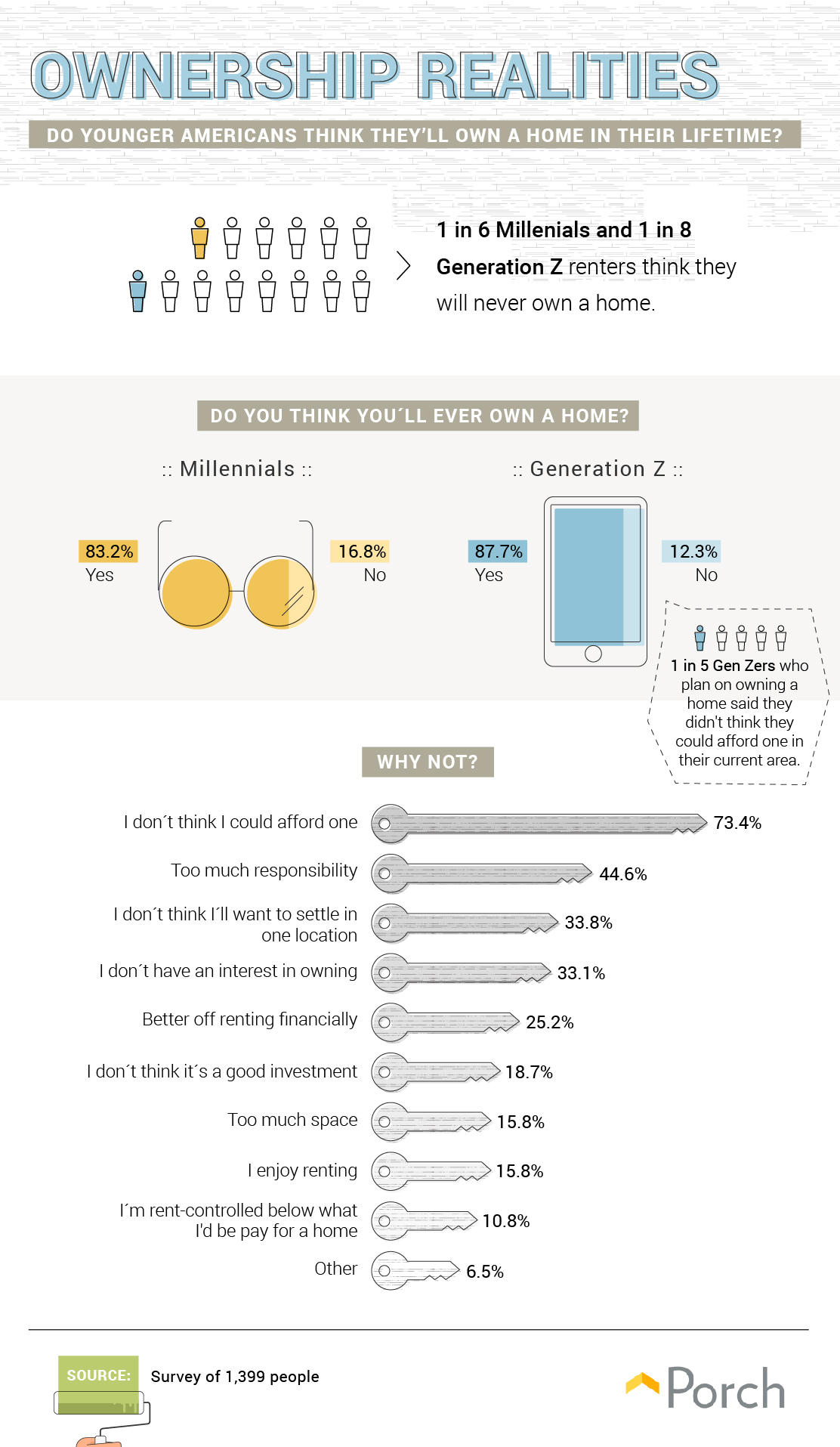

There are things in life we know we want. We may not know when we’d like to have them, but we know we want them. The majority of Gen Zers felt this way about having their own home. According to our findings, over 75 percent of Gen Zers said it was “very important” or “important” to own a home in their lifetime, but only 41 percent said it was important to achieve that goal in the next 10 years. Millennials were in a bit more of a rush: 56 percent said the same.

There are things in life we know we want. We may not know when we’d like to have them, but we know we want them. The majority of Gen Zers felt this way about having their own home. According to our findings, over 75 percent of Gen Zers said it was “very important” or “important” to own a home in their lifetime, but only 41 percent said it was important to achieve that goal in the next 10 years. Millennials were in a bit more of a rush: 56 percent said the same.  Tell the banks to slow down, because whether it takes a decade or 15 years, 42.8 percent of millennials and Gen Zers said they anticipated their family helping with their down payment. Your work is never done, parents.

Tell the banks to slow down, because whether it takes a decade or 15 years, 42.8 percent of millennials and Gen Zers said they anticipated their family helping with their down payment. Your work is never done, parents.

What about the housing market?

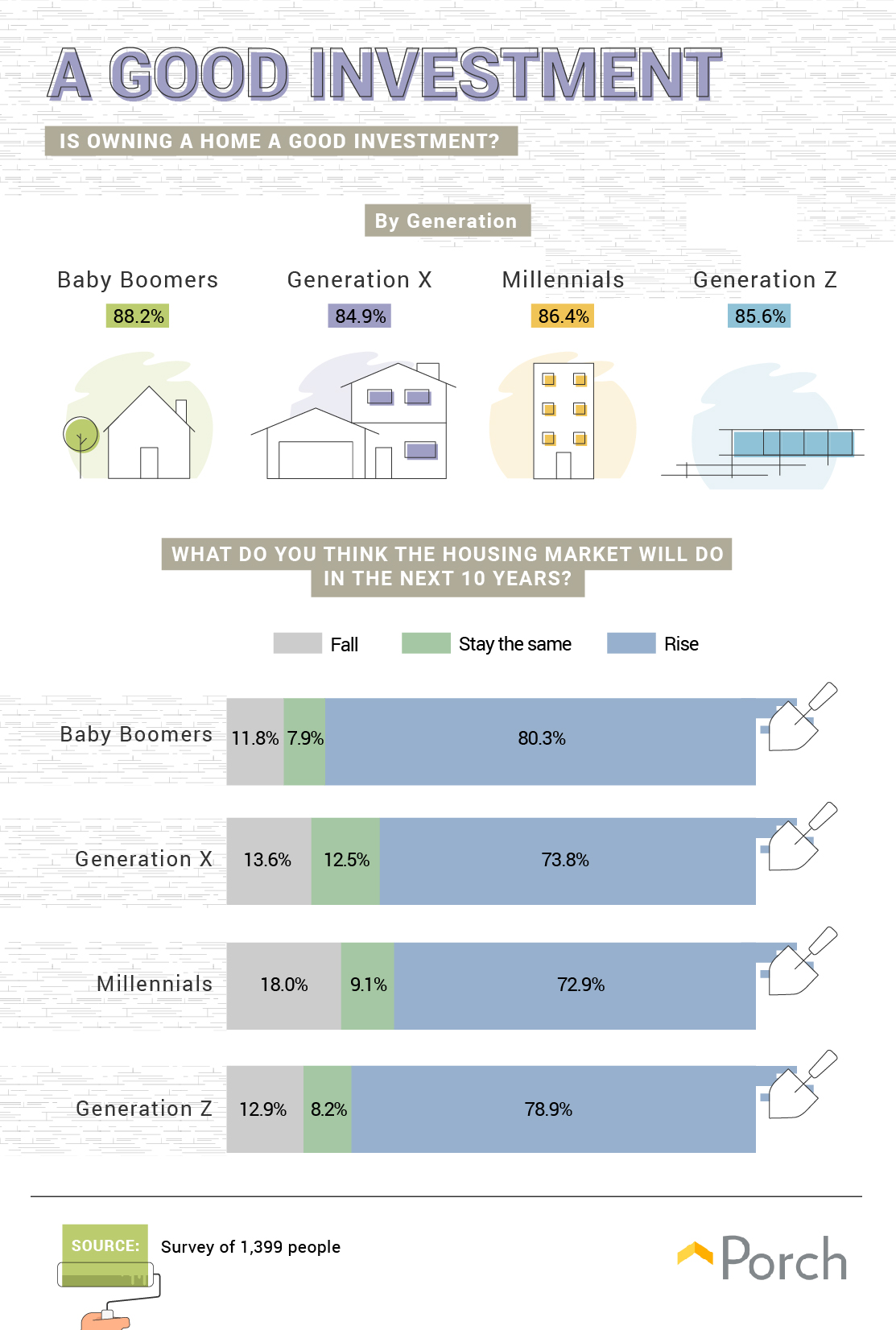

With baby boomers leading the charge, all four generations overwhelmingly believed purchasing a home was a good investment. However, fear of the future has a hold on millennials. Although they were more likely to believe it’s important to own a home in the next 10 years, 18 percent of millennials believed the housing market would fall during that time. Following closely behind baby boomers, 78.9 percent of Gen Zers believed the housing market would rise in the next decade.

With baby boomers leading the charge, all four generations overwhelmingly believed purchasing a home was a good investment. However, fear of the future has a hold on millennials. Although they were more likely to believe it’s important to own a home in the next 10 years, 18 percent of millennials believed the housing market would fall during that time. Following closely behind baby boomers, 78.9 percent of Gen Zers believed the housing market would rise in the next decade.

Is owning a home a safe investment?

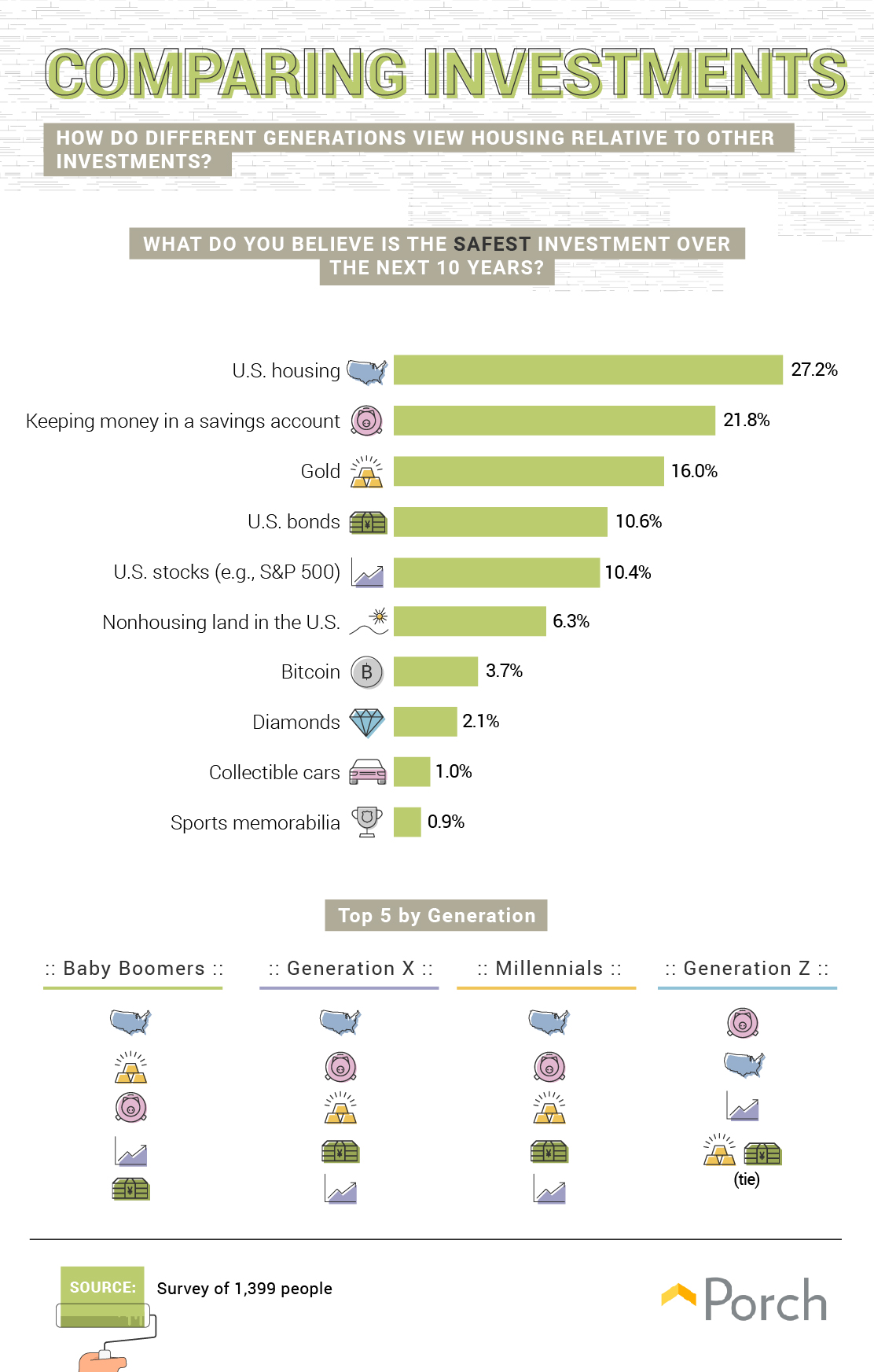

Gen Zers are optimistic about homeownership, but our findings indicate where their positive attitude takes a turn. Of the four generations, Gen Zers were the only group who ranked a savings account as a safer investment than housing (housing was No. 2 on their list). However, as a collective, 27.2 percent of respondents ranked housing as the safest investment to make over the next 10 years. Savings account followed behind at 21.8 percent.

Gen Zers are optimistic about homeownership, but our findings indicate where their positive attitude takes a turn. Of the four generations, Gen Zers were the only group who ranked a savings account as a safer investment than housing (housing was No. 2 on their list). However, as a collective, 27.2 percent of respondents ranked housing as the safest investment to make over the next 10 years. Savings account followed behind at 21.8 percent.

What Generation Z is skeptical about

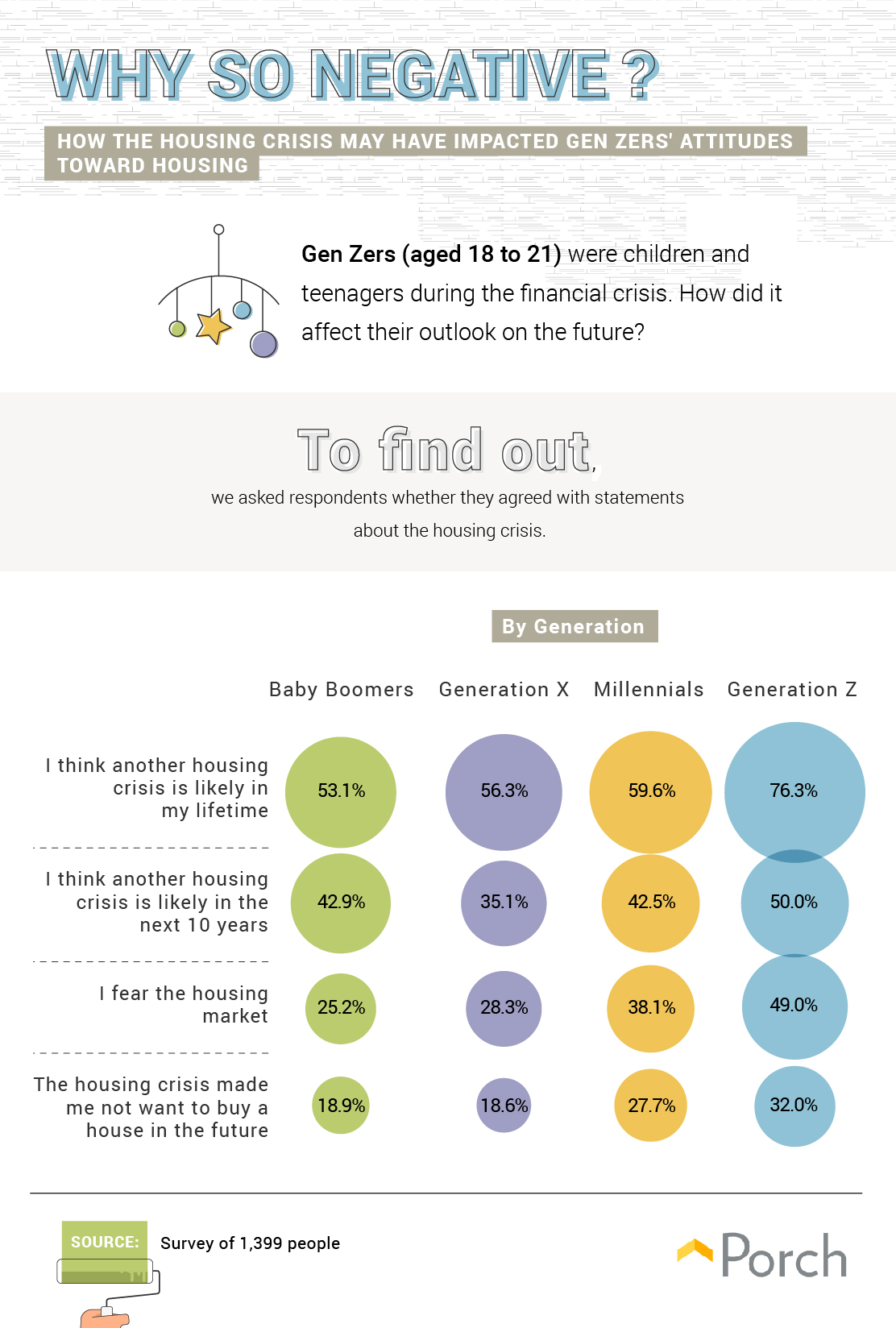

During the 2008 housing market crash, Gen Zers were at least 8 years old, which means they spent their growing years watching their parents and society stress about money. In exploring how financial stress affects children, experts warn that money troubles can stay in the family, negatively impacting kids if their parents don’t educate them. The good news? When children receive financial instruction from their parents, they’re more likely to be “smart about money.” Returning to our findings, it’s not startling to learn that Gen Zers said they believe a savings account is safer than the housing market. In fact, 76.3 percent believed they would experience a housing crisis in their lifetime, and 50 percent said it would happen in the next 10 years.

During the 2008 housing market crash, Gen Zers were at least 8 years old, which means they spent their growing years watching their parents and society stress about money. In exploring how financial stress affects children, experts warn that money troubles can stay in the family, negatively impacting kids if their parents don’t educate them. The good news? When children receive financial instruction from their parents, they’re more likely to be “smart about money.” Returning to our findings, it’s not startling to learn that Gen Zers said they believe a savings account is safer than the housing market. In fact, 76.3 percent believed they would experience a housing crisis in their lifetime, and 50 percent said it would happen in the next 10 years.

First comes fear, then safety

Buying a home has been a part of the American dream for decades; it’s evident in how baby boomers view homeownership. However, younger generations’ desire for innovation has left many questioning whether or not 20-somethings wish for a white picket fence of their very own. Our findings show that people as young as Gen Zers do care about owning a home, but they’re fearful of the future—will the housing market make it? While Gen Zers remain cautiously optimistic, they’re saving for a down payment on their first home and hope to make it happen in the next decade. At Porch, we’re here for you. Whether it’s in the next few weeks or next 10 years, we’ll assist with any project you need from the very moment you move into your new home. Visit us at Porch to learn more about the projects and areas we serve. Methodology and limitations To compile the data shown above, we surveyed 1,399 people on their attitudes and outlooks toward the housing market. The survey was conducted as a larger exploration of investment attitudes focused on generational differences. Our surveyed population was comprised of 254 baby boomers, 279 Gen Xers, 661 millennials, 194 Gen Zers, and 11 people who were from other generations. As with any survey, respondents may have been biased by their own experiences, thoughts, or recent behaviors. To control for this, we provided attention checks and validated questions in the survey to make sure people paid attention and to remove those who were obviously being dishonest. Fair use statement Like a great real estate agent or mortgage lender reference, the information shown above is best shared. We encourage you to share this material or any of its graphics for noncommercial purposes, but we ask that you cite the authors and link back to this page.